ASX-listed companies Leo Lithium Ltd. (AU:LLL), Liontown Resources (AU:LTR), and Core Lithium (AU:CXO) are popular lithium stocks in the market. Among these stocks, Leo Lithium offers a strong upside of 77% with a Strong Buy rating from analysts. On the other hand, according to analysts’ assessments, Liontown has received a Hold rating, while Core Lithium has been assigned a Moderate Sell rating on TipRanks.

Let’s take a look at the details.

Is Leo Lithium a Good Investment?

Leo Lithium is actively involved in the development of the Goulamina Lithium Project in Mali, which is expected to start production in 2024.

The company’s share price has soared in 2023, delivering a growth rate of 120% YTD. The recent exploration update from the company reveals impressive intercepts and grades beyond the boundaries of the existing mining area. This provides an opportunity for the company to expand and unlock additional value from the asset.

On TipRanks, LLL stock has a Strong Buy rating based on all four Buy recommendations. The average price forecast is AU$1.81 which is 77.5% above the current trading level.

What is the Future of Liontown Resources?

Liontown is an Australian mining company engaged in lithium and tantalum projects.

Currently, most brokers are adopting a neutral stance with Hold ratings on the stock. However, the recent takeover proposal from Albemarle represents the high quality of Kathleen Valley and the limited availability of growth prospects in the sector.

Overall, LTR stock has a Hold rating on TipRanks with one Buy and five Hold recommendations. The average price of AU$2.62 is 9.6% lower than the current price level.

Are CXO Shares a Good Buy?

Core Lithium is involved in the exploration and development of lithium and other mineral deposits in the Northern Territory and South Australia.

After hitting a record gain of 1890% in the last three years, the company’s stock experienced a decline of 9% YTD. Analysts currently have a bearish take on the stock, considering the decline in lithium prices. But they also believe lithium prices are expected to recover in the long run, driven by global demand especially in China.

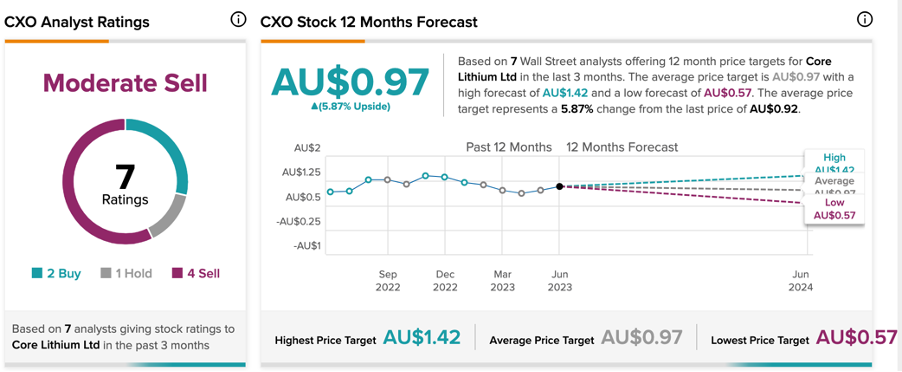

CXO stock has a Moderate Sell rating on TipRanks based on a total of seven recommendations, including two Buy, one Hold, and four Sell. The average target price of AU$0.97 represents a growth of 5.8% on the current trading price.

Ending Notes

The Australian mining sector has always been appealing to investors seeking to diversify their portfolios. After experiencing robust growth over the past three years, the lithium sector has witnessed a slowdown in its expansion due to declining prices. However, analysts believe that the anticipated surge in demand for lithium from China will reignite the upward trajectory of lithium prices.