The FTSE 100-listed AstraZeneca PLC (GB:AZN) has joined forces with the U.S.-based drug discovery company Absci Corporation (NASDAQ:ABSI) to leverage artificial intelligence (AI) in developing an antibody for cancer treatment. The deal is valued at $247 million and represents a new partnership to employ AI in drug development. The company did not specify the particular cancer treatment targeted by this deal.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Absci is a biologics company that uses AI for large-scale protein analysis to develop novel oncology treatments. With this collaboration, AstraZeneca strives to benefit from Absci’s AI technology for its oncology therapy, which is a priority area for the company. The deal includes an initial payment to Absci, funding for research and development work, milestone-linked payments, and royalties on future product sales.

AstraZeneca is a prominent global pharmaceutical company catering to billions worldwide. The company is strategically positioned in three primary sectors: Oncology, Rare Diseases, and BioPharmaceuticals.

Strong Foothold in Cancer Treatment

AstraZeneca recently raised its profit outlook for the full year based on its strong pipeline of cancer drugs. Last month, the company announced its third-quarter results for FY23, which revealed a remarkable 13% surge in sales (excluding COVID-19-related revenue) to $11.49 billion and exceeded expectations. The growth was primarily credited to the strong performance of its successful cancer treatments and sustained demand in emerging markets.

A breakthrough from the Absci partnership could help AstraZeneca create innovative disease treatments while simultaneously reducing the developmental costs involved. The company called the deal an “exciting opportunity” and aims to enhance its biologics discovery process through such partnerships.

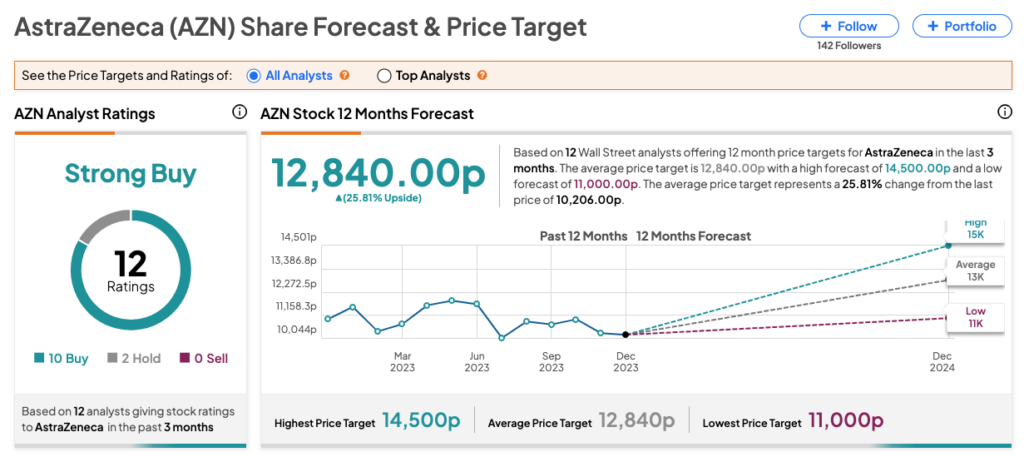

Is AstraZeneca Share a Good Buy?

On TipRanks, AZN stock has a Strong Buy consensus rating, supported by ten Buy and two Hold recommendations. The AstraZeneca share price forecast stands at 12,840.0p, which shows a potential upside of 26%.