The FTSE 100-listed Legal & General Group PLC (GB:LGEN) today completed a landmark pension deal with Boots UK Limited for £4.8 billion. As part of this deal, Boots will transfer its pension obligations for 53,000 current and future retirees to Legal & General. It represents the largest single UK pension risk transfer in terms of premium size.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal also set the stage for a possible sale by Boots’ owner, Walgreens Boots Alliance (NASDAQ:WBA). Recently, Walgreens hinted at a relaunch of the sales process for Boots, a leading provider of health and beauty products in the UK. After this pension deal, Boots has successfully eliminated a hurdle for a potential sale by Walgreens.

Legal & General Group is a leading financial services company, providing services such as insurance, wealth management, savings, and investment solutions. The company is known for its diverse range of financial products and services catering to individuals, businesses, and institutional clients.

Flourishing Pension Transfer Deals in the UK

The UK market is set to witness a record year for such pension deals, considering market volatility and rising interest rates. The demand for such deals is surging as affordability is now higher for employers.

With this recent buy-in, Legal & General’s year-to-date Pension Risk Transfer (PRT) business has achieved an impressive total of £13.4 billion globally. The UK market played a significant role, contributing £7.2 billion, while the U.S. market added $1.5 billion. The company anticipates more such deals in the near future, driven by an increasing number of pension schemes nearing buyout status.

Is Legal and General Stock a Good Buy?

So far, in 2023, the company’s stock performance has been volatile, similar to that of its peers. Year-to-date, the stock has been trading down by 1.6%. Nonetheless, analysts maintain a bullish stance on the stock, citing favourable underlying business metrics. Not to forget the attractive dividend yield of 8.6%, which positions LGEN as one of the top dividend-paying companies in the UK market.

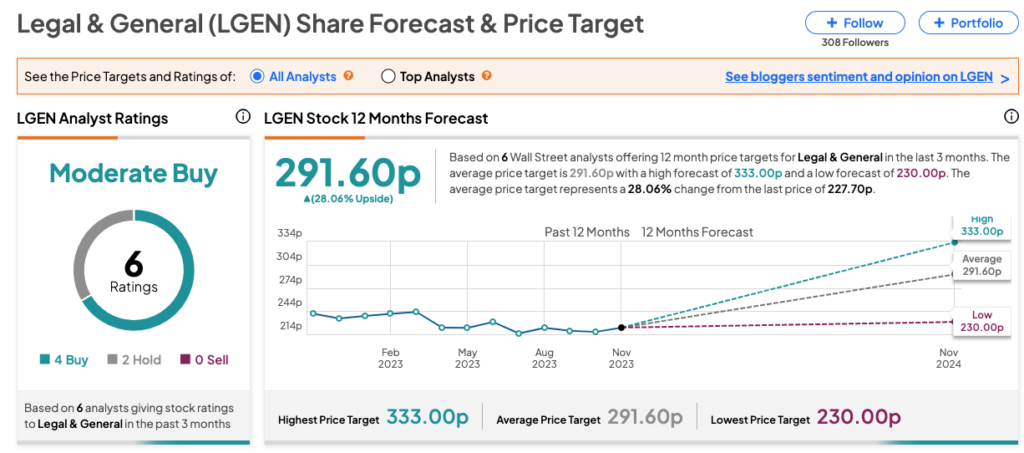

On TipRanks, LGEN stock has a Moderate Buy rating backed by four Buy and two Hold recommendations. The Legal and General share price prediction is 291.6p, which is 28% higher than the current price level.