The FTSE 100-listed Entain PLC (GB:ENT) will pay £615 million to settle a bribery case involving its former Turkish subsidiary. The settlement will end a long investigation, which was started by the British tax authority HM Revenue & Customs (HMRC) in 2019.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This settlement also marks the first Deferred Prosecution Agreement that the Crown Prosecution Service (CPS) has entered into since the introduction of this legal tool in the UK in 2014.

Entain is a multinational gaming and sports betting corporation that operates in approximately 20 countries. The company’s brand portfolio includes Bwin, Coral, Ladbrokes, Partypoker, PartyCasino, and others.

The Investigation Details

According to the investigation, Entain was accused of lacking sufficient procedures to prevent bribery activities in its former Turkish unit, which was sold in 2017. However, the company stated that it has conducted a thorough review of its anti-bribery policies and has implemented measures to enhance its compliance program and controls.

The total penalty includes a payment of £585 million, representing the profits it generated from the bribery activities. In addition, the company will contribute £20 million to charitable causes and cover HMRC’s and the CPS’s costs with a payment of £10 million. These amounts will be disbursed over the next four years, utilizing funds set aside by the company to cover these penalties.

Entain’s management has welcomed the decision, and it believes this will bring closure to its longstanding compliance issue.

Is Entain a Good Stock to Buy?

Entain’s shares ended the day at a loss of 0.65% in trading. The stock has lost around 40% of its value so far in 2023, mainly due to falling online gaming revenues. The company also reduced its net gaming revenues forecast for fiscal year 2023.

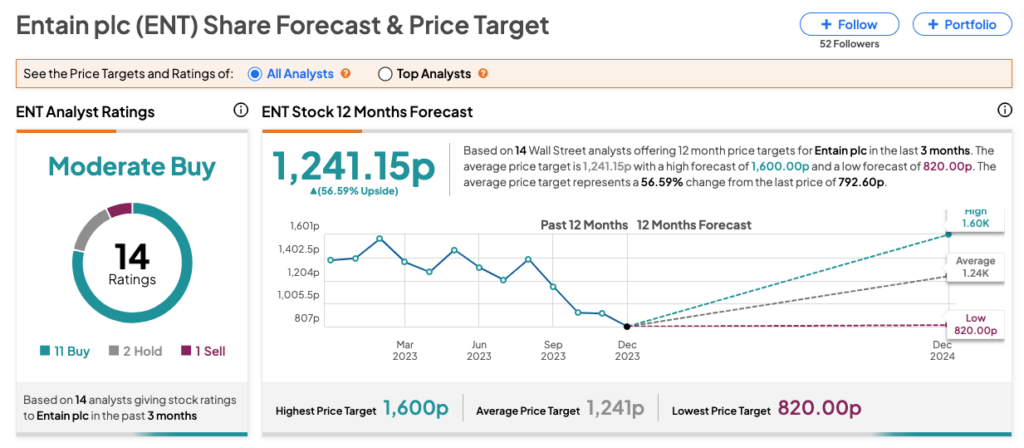

On TipRanks, analysts hold a bullish view on ENT stock and have rated it as Moderate Buy. This includes eleven Buys, two Holds, and one Sell recommendation. The Entain share price prediction is 1,241.15p, which is higher than the current trading levels and implies an upside of 56.6%.