China’s second-largest e-commerce retailer JD.com (HK:9618) has won the favor of DBS analyst Tsz Wang who has a Buy rating on the stock but cut the price target to HK$181 (109.7% upside) from HK$214. Wang is confident about JD.com’s strategic shift toward high-growth items such as grocery and healthcare as the demand for electronics and home appliances diminishes due to macro challenges. The analyst expects JD to gain growth momentum in FY24 following these adjustments in its business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Beijing-based JD.com is one of the largest Chinese e-commerce companies based on transaction volume and revenue. JD is also a recognized player in China’s logistics and technology market with a state-of-the-art global supply chain network and innovative robotics and automation technology. Despite a resilient business to boast about, 9618 shares have lost nearly 65% in the past year. This is mainly due to China’s slow economic recovery and price-sensitive customers.

Here’s More About DBS’ Optimism

Analyst Wang noted that JD.com had a 19% market share in China’s e-commerce retail sector based on GMV (Gross Merchandise Value) in 2022. Looking ahead, Wang is optimistic that JD will be able to garner more traction in its retail sales and GMV as it shifts focus toward grocery and healthcare products.

Based on the same, Wang estimates JD’s sales to grow by 3%, 6%, and 7% in FY23, FY24, and FY25, respectively. However, the analyst reduced his non-GAAP net profit estimates for these years by 5%, 7%, and 6% to reflect higher marketing and customer acquisition costs. He expects JD’s adjusted earnings to grow by 18%, 13%, and 12% in FY23, FY24, and FY25, respectively.

Finally, Wang listed three factors that have the potential to accelerate JD’s growth trajectory – demand for electronics and home appliances items could revive faster than expected, margins could improve more than anticipated, and expenses related to the subsidy scheme started in March 2023 could be potentially lower than expected.

Is JD.com a Good Stock to Buy Now?

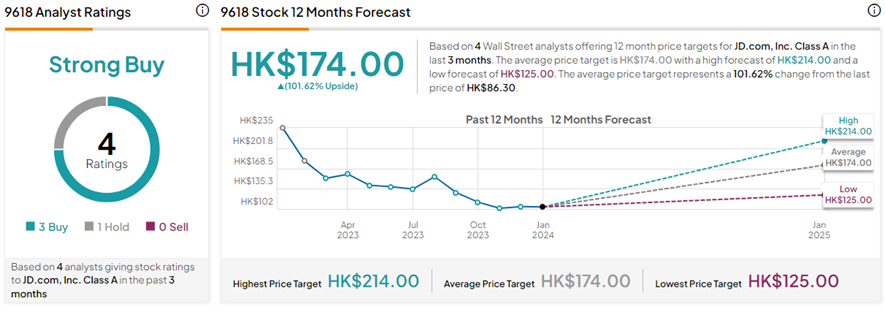

With three Buys and one Hold rating, 9618 stock has a Strong Buy consensus rating. The JD.com share price forecast of HK$174 implies 101.6% upside potential from current levels.

Ending Thoughts

JD.com is undoubtedly one of the biggest players in China’s e-commerce space. The current macro picture may not be conducive for retailers but JD is taking the right measures to improve its profitability and performance. This makes JD.com a favorable pick for DBS analyst Tsz Wang.