The share price of the UK-based ITV PLC (GB:ITV) declined over 5% yesterday after the company warned of reduced content spending this year. The company has decided to cut around £10 million in spending from its £1.29 billion content budget. This comes as a response to the “challenging” economic conditions that have negatively impacted the demand for advertising and content among broadcasters.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

ITV Studios, the largest production company in the UK, is renowned for producing popular shows such as Hell’s Kitchen, The Voice UK, and many more.

Q3 Trading Update

In the first nine months of 2023, the company’s revenues grew by 1% to £2.98 billion. This growth was primarily driven by the positive performance of its studio and digital revenues, which managed to counterbalance the decrease in advertising revenue.

ITV Studios witnessed an increase of 9% in revenues to £1.52 billion. However, the M&E (media and entertainment) business revenues were down by 7% to £1.46 billion due to a 7% drop in its advertising business. On the plus side, ITVX achieved significant success, with a remarkable 27% increase in total streaming hours, contributing to a 23% growth in digital revenue. Notably, the growth in digital advertising revenues continues to outshine that of other broadcasters, highlighting the opportunities offered by ITVX.

The company is also confident in achieving £15 million in cost savings for 2023, which is part of its goal of £50 million in cost savings between 2023 and 2026.

ITV will publish its fourth-quarter earnings report in February 2024.

Outlook

For ITV Studios, the company expects revenue growth of at least 5% annually until 2026. For the full year 2023, ITV anticipates achieving approximately 3% growth in total Studios revenue, which follows a remarkable 19% growth in 2022. The company remains concerned about the advertising market and expects its total advertising revenue (TAR) to decline by 8% in 2023 compared to last year.

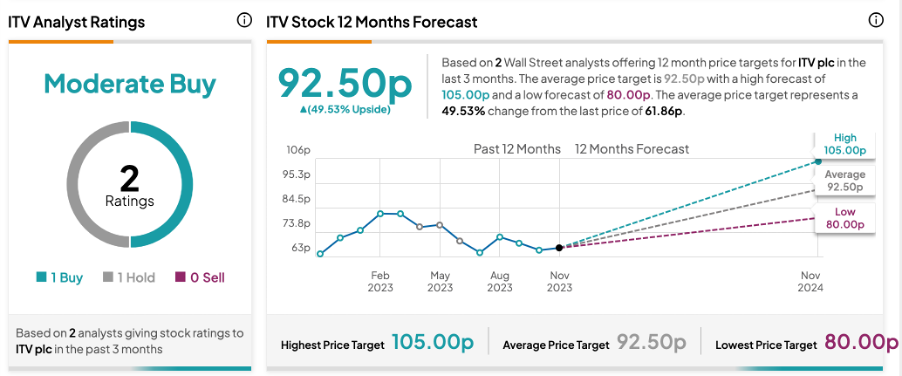

What is the Price Target for ITV?

The stock went down by 5.61% on Wednesday, reaching its lowest point since October 2022, trading at approximately 61p.

Based on analysts’ assessments available on TipRanks, ITV stock has received a Moderate Buy rating, supported by one Buy and one Hold recommendation. The ITV share price prediction for a 12-month period is 92.5p, which implies a huge upside of 50% from the current price.