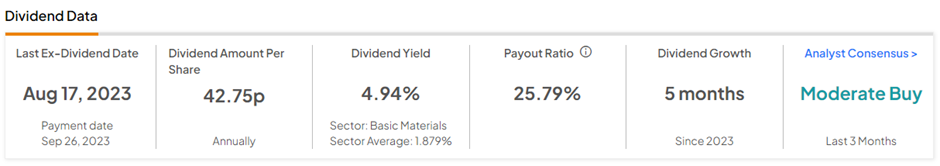

The FTSE 100-listed miner Anglo American PLC (GB:AAL) has a lucrative dividend yield of 4.94%. Anglo American is the world’s largest platinum producer. It also mines diamonds, copper, nickel, iron ore, and steelmaking coal. AAL paid its most recent interim dividend of 43.83p per share on September 26, 2023. The stock had a terrible 2023 as the company witnessed a slump in demand for most of the metals it mines amid macro pressures. That said, the long-term growth story seems attractive due to the company’s diversified asset base.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Anglo American’s Recent Performance

The miner has been hit by slumping metal prices, increasing costs, and operational challenges. In December, the company announced production cuts to its mining output and pledged to reduce capital spending by $1.8 billion through 2026. The slew of challenges has prompted analysts to believe that Anglo American could become a potential takeover target. Unfortunately, AAL shares have lost 38.2% of their value in the past year.

The company paid special dividends in Fiscal 2021 and 2022. However, with the current production cuts and the disappointing mining update, the possibility of giving special dividends in 2023 seems a distant reality.

Despite the ongoing challenges, Anglo American’s long-term growth potential looks attractive. The company expects solid long-term demand for its metals and minerals, backed by favorable trends like decarbonisation and urbanisation. Moreover, the company is committed to its 40% dividend payout policy.

Is Anglo American a Good Buy?

Recently, Jefferies analyst Chris LaFemina reiterated a Buy rating on AAL stock and set the price target at 2,500.00p (33% upside potential).

On TipRanks, AAL stock has a Moderate Buy consensus rating based on eight Buys and five Hold ratings. The Anglo American PLC share price target of 2,457.81p implies 30.6% upside potential from current levels.