The share price of the Dax 40-listed Bayer AG (DE:BAYN) declined sharply after it faced a major setback in its new anti-clotting drug, casting doubt on its most promising development project. The company today announced that it has stopped its phase III trial for a cardiovascular drug, asundexian, as it was concluded to be less effective than the current standard treatment.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In separate news, the company received an order to pay $1.56 billion in the latest U.S. lawsuit related to its widely used Roundup weedkiller, further impacting market sentiment.

The stock experienced a significant one-day decline, plummeting to its lowest level in over a decade. At the time of writing, the shares were trading down by almost 20%. This leads to a year-to-date loss of over 30% in trading.

Bayer is a German biotechnology company engaged in the research, development, and manufacturing of products in the pharmaceuticals, consumer health, and crop science sectors.

Growing Struggles

The company’s pharmaceutical segment is currently struggling with the expiration of patents on some of its top-selling drugs and has significant expectations for asundexian. Asundexian was considered the most promising drug in its pipeline and was expected to generate a revenue of €5 billion annually.

These obstacles added additional pressure on the CEO, Bill Anderson, who is currently in the midst of finalizing a turnaround plan for the company. The group is actively exploring various strategic options, with the potential consideration of a split-off.

What is the Target Price for Bayer Stock?

After today’s downfall of the stock, analysts have expressed mixed opinions about the stock.

Barclays analyst Emily Field downgraded her rating on the stock from Buy to Hold, forecasting a growth rate of around 20%. She mentioned this as a total surprise and said, “Removing asundexian from our model suggests significant challenges ahead for the company’s pharma business.”

On the other hand, analyst Charles Bentley from Jefferies reiterated his Buy rating on the stock, predicting a huge upside of 80% in the share price.

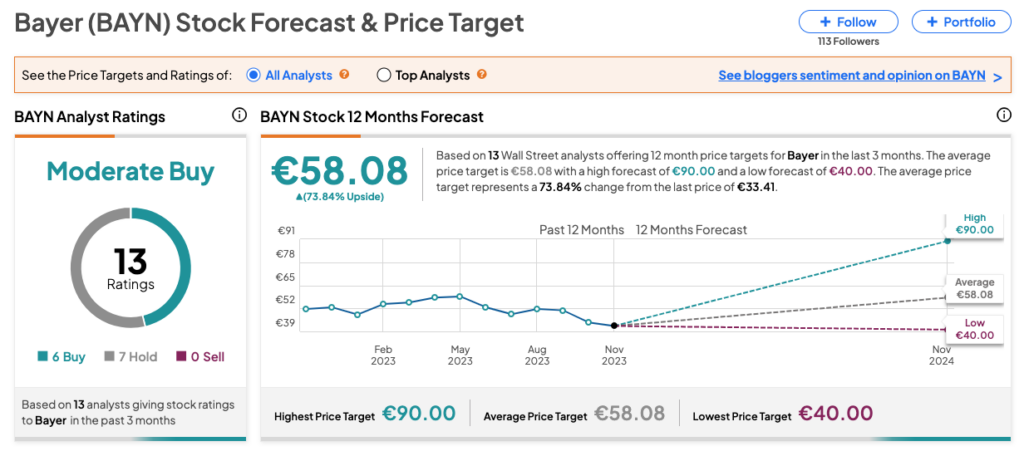

According to TipRanks’ rating consensus, BAYN stock has received a Moderate Buy rating, backed by recommendations from 13 analysts. It includes six Buy and seven Hold ratings. The Bayer share price forecast is €58.08, which implies an upside of 74% on the current trading level.