Italy-based Intesa Sanpaolo S.p.A.’s (IT:ISP) share price has received a bullish stance from analysts, who have rated it as Strong Buy and predict more than 35% upside potential. Over the last seven days, the stock has received Buy rating confirmation from analysts, underscoring their confidence in the company’s future potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Intesa Sanpaola is the largest banking group in Italy, with global operations across Europe, Asia, the U.S., and Africa.

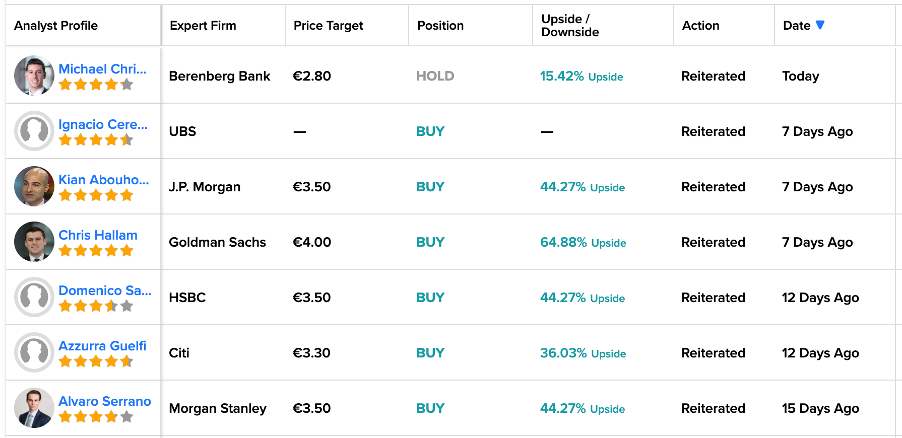

Recent Ratings

The stock has seen a lot of positive action from analysts over the last 15 days. The ratings were mainly driven after the company announced its Q2 2023 earnings last month. After posting record half-year numbers, the company has revised its profit outlook, citing the anticipation of sustained revenue growth driven by higher interest rates. The analysts are also bullish on the company, as they feel it has the capacity to maintain sustainable profitability in a challenging environment due to its robust and diversified business model.

Analyst Chris Hallam from Goldman Sachs has the highest price target on the stock at €4.00. He confirmed his Buy rating seven days ago, implying a huge upside potential of 64%.

Most recently, Berenberg Bank’s analyst Michael Christodoulou reiterated his Hold rating on the stock today. His price target of €2.8 suggests a growth rate of 15.4% in the share price.

Analysts from J.P.Morgan, HSBC, UBS, and more are also bullish on the stock and have maintained their Buy ratings.

Positive Outlook

Last month, the company reported a net profit of €2.27 billion in its second-quarter results for 2023. The net interest income increased to €3.58 billion, as compared to €2.09 billion reported last year. For the full year 2023, the company expects to post a net interest income of more than €13.5 billion. The expected net profit for 2023 is €7 billion, and further growth is anticipated for 2024-25.

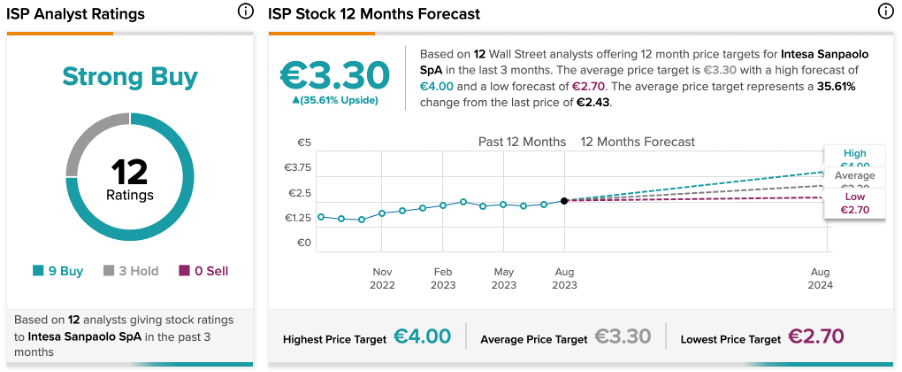

Intesa Sanpaolo Share Price Target

According to TipRanks, ISP stock holds a Strong Buy rating, supported by nine Buy and three Hold recommendations. The average target price stands at €3.3, indicating a significant 35.6% increase from the current trading level.

In the last 12 months, the stock has experienced a notable increase of 40.7%.

Conclusion

Analysts hold a positive outlook on the company’s profit and net interest income growth projections for 2023 and the future. They have assigned the stock a Strong Buy rating and anticipate a further 35% increase in its share price.