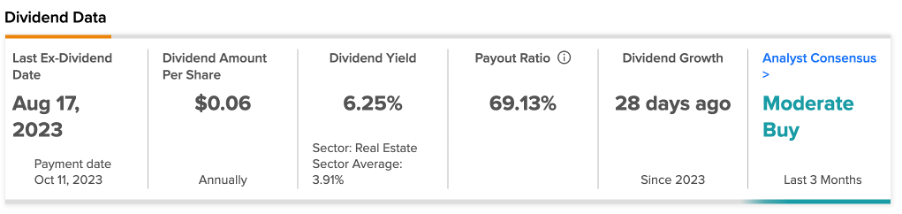

SGX-listed Hongkong Land Holdings (SG:H78) (GB:HKLD) offers an attractive dividend yield of 6.25%, providing an excellent income opportunity to investors. The yield also surpasses the standard industry average of 3.9% and gives investors a chance to broaden their income portfolio.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

YTD, the Hongkong Land share price is down 20%.

Hongkong Land is engaged in the investment, management, and development of real estate properties. The company owns a diverse portfolio, including commercial and residential properties across the Asian region.

Hongkong Land Dividend History

Despite the challenges posed by the pandemic, the company continued to honor its dividend payments. It has consistently maintained an annual dividend of $0.22 per share since 2018. The company pays dividends twice a year, as interim and final. In 2023, the company declared an interim dividend of $0.06 per share, payable in October 2023. This is the same as the interim dividend payment in 2022.

The Rebound

The challenging economic conditions in China dampened consumer confidence and impacted the company’s performance. However, the company is now witnessing improved sentiment in its office and retail portfolios, driven by the ongoing recovery of the local economy.

Over the last two years, Hongkong Land has significantly increased its investments in Asia, nearly doubling them from the pre-pandemic figure of $1.8 billion to an average of $3.3 billion. These investments reinforced the company’s core portfolio in Hong Kong and expanded its presence in Southeast Asia.

The company also announced its intention to launch 10 new retail developments within the next five years, spanning seven different cities in China, bringing the total number of commercial projects to 17.

Hongkong Land Share Price Target

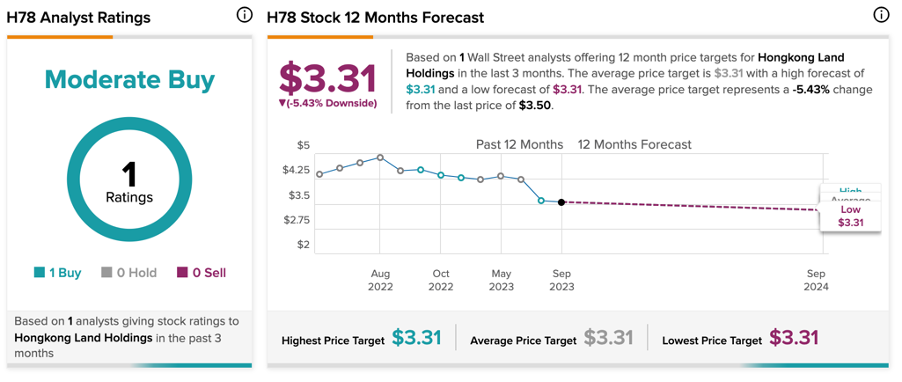

According to TipRanks’ rating consensus, H78 stock has received a Moderate Buy rating based on one Buy recommendation from Jefferies. The Hongkong Land share price target is $3.31, which is 5.4% lower than the current price level.