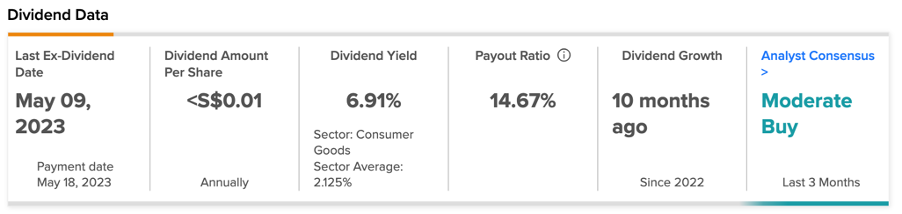

SGX-listed Golden-Agri Resources Limited (GAR) (SG:E5H) has an attractive dividend yield of almost 7%, as compared to the sector average of 2.12%. The company is the highest dividend payer in the Singapore market. It also demonstrates robust fundamentals, including strong earnings growth and profitability, which makes the dividend story more convincing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GAR stands as one of the leading palm oil companies globally, operating across 12 countries. The company boasts a brand portfolio encompassing 30 products.

In terms of share price growth, GAR stock has received a Moderate Buy rating on TipRanks. The stock has been trading down for the last six months, at a loss of 8.76%.

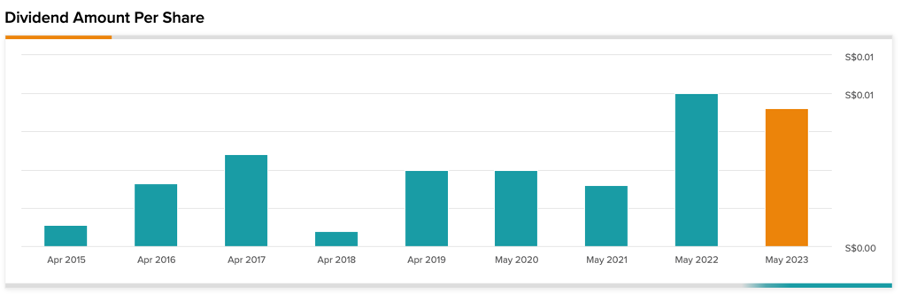

Golden-Agri Dividend History

The company’s dividend strategy is to allocate a portion of up to 30% of its underlying profit as dividends. It pays dividends twice a year, as interim and final. In 2022, the company declared a year-end dividend of S$0.0099 per share, resulting in a total dividend payout of S$0.0179 for the year. That marked the company’s highest-ever dividend and represented a 12% increase compared to the previous year.

Strong Earnings Support

In August, the company reported solid first-half earnings for 2023, despite falling palm oil prices. The company observed the normalization of CPO (crude palm oil) prices from their record highs last year, which declined by 40% to $949 per tonne. However, the company’s business model helped it overcome the volatility and post an EBITDA of $478 million for the first half.

The company’s downstream segment experienced a significant rise in sales volume, rebounding from the prior year and culminating in revenue of $4.8 billion.

Looking ahead, the company is strategically positioned to capitalize on the increasing global demand for palm oil. This positioning will support the company in sustaining and enhancing both its profitability and dividend distributions.

Golden Agri Resources Share Price Target

According to TipRanks’ rating consensus, E5H stock has received a Moderate Buy rating, based on one Buy recommendation from RHB Capital. The Golden-Agri share price target is S$0.28, which is 14% higher than the current price level.