SGX-listed Suntec Real Estate Investment Trust (SG:T82U) offers a dividend yield of 6.38%, making it a viable option for income investors. In Singapore, REITs (real estate investment trusts) are obligated to distribute at least 90% of their income as dividends. As a result, they remain a viable choice for income-seeking investors.

Suntec REIT owns a portfolio of income-generating commercial real estate properties used for office and/or retail purposes. The company’s property holdings are located in Singapore, the UK, and Australia.

In terms of capital appreciation, the company also offers an upside potential, as discussed below. Year-to-date, the stock has traded down by 12%.

Income investors have a wide range of choices on the SGX when it comes to dividend-paying stocks. However, dividend tools from TipRanks simplify the often cumbersome process of choosing stocks within a specific market. Here, we have used the Top Singapore Dividend Stocks tool, which lists the top dividend-paying companies in this market.

Suntec REIT Dividend

Suntec’s Q3 trading update was in line with market expectations. The trust’s gross revenue and net property income in Q3 experienced a year-on-year increase of 15% and 9.7%, respectively. These positive figures were primarily attributed to the strong performance of its flagship asset, Suntec City. Despite these positive aspects, the trust’s performance was hindered by unfavourable foreign exchange movements and increased financing/debt costs.

This resulted in a 14% year-on-year decline in the third-quarter 2023 dividend (distribution per unit) amounting to SG$0.01793, paid in November 2023. The company anticipates that the high financing costs will continue for the rest of the year.

The company will announce its fourth-quarter results for FY23 on January 24, 2024.

Is Suntec REIT a Good Buy?

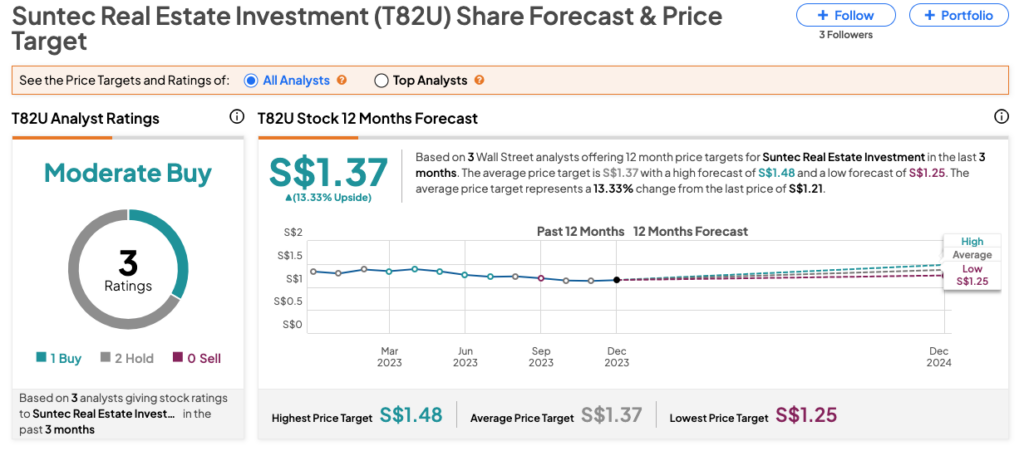

On TipRanks, T82U stock has received a Moderate Buy rating based on one Buy and two Hold recommendations. The Suntec REIT share price target is S$1.37, which is 13.3% higher than current trading levels.