The UK-based tobacco players are currently struggling with higher inflation costs and changing market dynamics towards smoke-free alternatives. However, their brand value, huge customer base, and pricing power make them able to withstand any challenges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In today’s piece, we will compare British American Tobacco (GB:BATS) and Imperial Brands (GB:IMB) and find out which stock is better from an investment point of view.

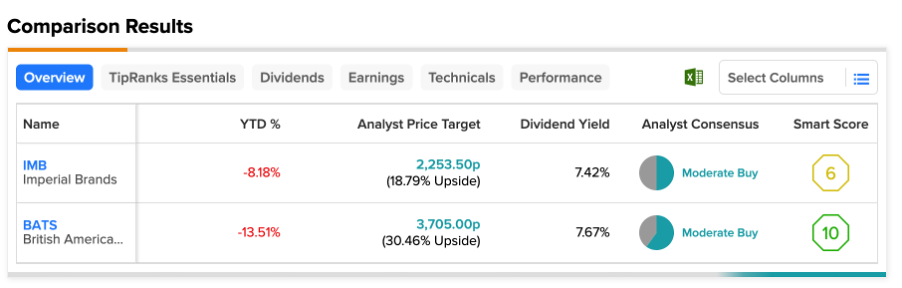

Based on this backdrop, we have used the TipRanks stock comparison tool to compare these stocks based on various criteria to help make a better decision.

BATS and IMB are leading tobacco companies that manufacture and sell cigarettes and other tobacco products globally.

Let’s discuss the stocks in detail.

British American Tobacco (BAT)

BAT owns popular brands like Dunhill, Kent, and Camel as well as new categories of products like Vuse, Glo, Velo, and more.

In February, the company published its 2022 earnings, with revenue up 2.3% due to strong performance from the new category segment. The company is also confident of achieving its £5 billion revenue target from the new category by 2025 and hitting profitability in 2024. The non-combustible segment now contributes around 15% to total revenues, which was higher than 12.6% in 2021.

Even with the hovering regulations on combustible products in the U.S. expected in June 2023, BAT is well-positioned to capitalize on its non-combustible brands.

The stock is also popular among income investors, with a dividend yield of 7.67%. In 2022, the company increased its interim dividend by 6% to 230.9p, which will be payable in four equal installments.

Compared to the Smart Score tool, BAT has a “Perfect 10,” reflecting its strength in beating the market’s returns.

Is British American Tobacco Stock a Good Buy?

According to TipRanks’ analyst consensus, BATS stock has a Moderate Buy rating. The stock has a total of 10 recommendations, of which six are Buy.

The average price forecast of 3,705p represents a growth of 30% from the current levels. The price ranges from a low forecast of 3,100p to a high forecast of 4,100p.

Imperial Brands (IB)

IB’s brand portfolio includes some well-known names like Davidoff, West, and Winston and new-generation products like Pulze, blu, and iD.

In the smoke-free market, IB is facing tough competition from BAT and Altria Group (NYSE:MO) (GB:0R31) in the U.S. The company’s annual results for 2022 showed its combustible products still contributed more to its revenues. However, with the growing health and environmental concerns over traditional smoking products, tobacco companies will have to drive more growth from the smoke-free segment.

On the plus side, the company is leaving no stone unturned to tap this market and expand its products. In 2022, the company’s next-generation product revenue grew by 10.8% to $247.4 million. The company has gotten favorable results from the trial run of its e-cigarette product, “blu,” in the U.S. This will enable the company to continue expanding the product.

In terms of dividends, the company increased its dividends for 2022 by 1.5% to 141.17p. IB’s dividend yield of 7.42% is slightly lower than that of BAT.

On the Smart Score tool, IB has earned a score of 6, which means fewer chances to outperform the market.

Imperial Brands Share Price Forecast

IMB stock has a Moderate Buy rating on TipRanks, based on six Buy and three Hold recommendations.

The average price target is 2099.4p, implying an upside of 16.5%. The analyst price target has a high forecast of 2,300 and a low forecast of 1,780p.

Conclusion

Tobacco companies hold the power of higher dividends, which is attractive for investors, especially during the current challenging times. Both IB and BAT remain good-dividend payers. However, BAT is well-positioned to drive more growth in the non-combustible segment and also maintain its dominance in traditional smoking products.

IB, on the other hand, is still trying to make its place in the smoke-free segment and needs some turnaround strategies to grab more market share.