Industria de Diseño Textil, S.A., or Inditex (ES:ITX), is a retail company based in Spain with operations in more than 200 markets globally. The company owns brands like Zara, Pull & Bear, Massimo Dutti, etc. under its portfolio.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Yesterday, analyst William Woods from Bernstein confirmed his Buy rating on the stock, forecasting a growth of 9.6% in the share price. Woods believes the ROI (return on investment) remains strong for Inditex as compared to other retail areas. Woods also mentioned Inditex as an “outperformer,” considering its consistent growth.

Q1 2023 Numbers

Over the last 10 days, the stock has received a lot of action from analysts after posting its first-quarter earnings of 2023 on June 7. The company reported higher numbers in sales and earnings for the quarter.

Inditex reported a net profit of €1.17 billion, which increased from €766 million in Q1 2022. The company was also able to grow its margins, which in turn pushed the EBITDA by 14% to €2.2 billion as compared to €1.92 billion a year ago. The net income grew by a huge 54% to €1.2 billion, driven by favorable results in all regions.

Moving forward, the company is targeting stable margins to enhance operational efficiencies and elevate its competitive edge to new heights.

Analysts’ Opinion

Analysts are also confident about the stock based on its pricing policy, supply chain management, expansion strategies, and automation, which will further drive earnings for the company.

Eight days ago, J.P. Morgan analyst Georgina Johanan also reiterated her Buy rating on the stock at a price forecast of €38, similar to Woods’ target. This also implies an upside potential of 9.8%.

Nine days ago, Richard Edwards from Goldman Sachs also affirmed his Buy rating on the stock, anticipating growth of more than 21% in the share price.

On the flip side, analysts from Morgan Stanley and Credit Suisse predict a downside in the share price with Hold and Sell ratings, respectively.

What is the Price Target for Inditex?

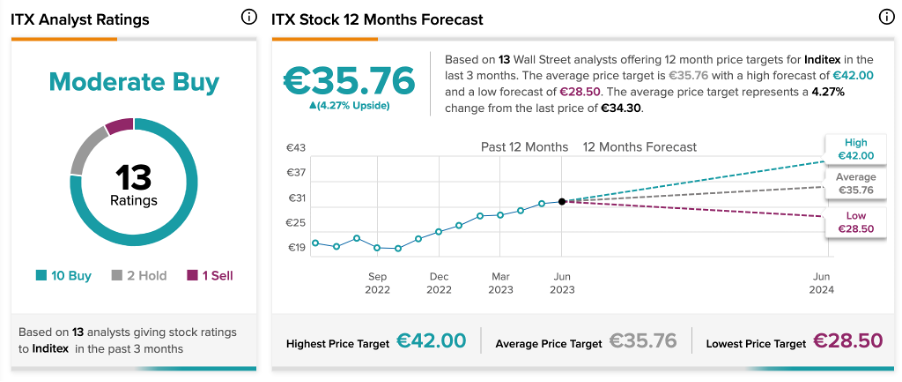

According to TipRanks’ rating consensus, ITX stock has a Moderate Buy rating backed by a total of 13 recommendations. It includes 10 Buy and two Hold ratings.

The average price forecast is €35.76, which is 4.3% higher than the current share price.

Conclusion

Inditex’s business model attains a distinctive market position that presents significant growth opportunities moving forward.

Overall, analysts have rated the stock as Moderate Buy and believe it could be a good addition for investors in the long run.