Using the TipRanks Trending Stocks tool for Spain, we have shortlisted oil and gas company Repsol (ES:REP) and banking group Banco Santander (ES:SAN), which have recently garnered attention from analysts. Analysts foresee a potential upside of nearly 45% for Santander, whereas Repsol is projected to have a growth potential of 23%.

Now, let’s delve into some details about these stocks.

Repsol S.A.

Repsol operates within the energy sector and engages in activities such as crude oil and natural gas production as well as petroleum refining.

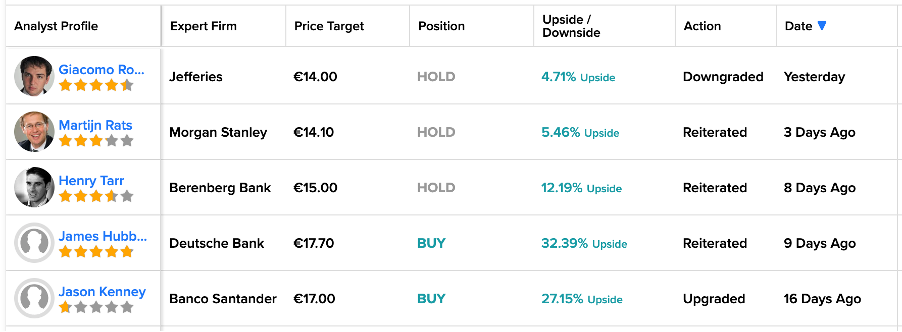

Recently, the stock has seen a lot of mixed action from analysts. Yesterday, analyst Giacomo Romeo from Jefferies downgraded his rating from Buy to Hold on the stock. Romeo believes the company might face difficulties in outperforming amidst the current challenging macro environment. This is primarily attributed to lower margins and limited potential for distribution growth.

Contrary to this, nine days ago, Deutsche Bank analyst James Hubbard reiterated his Buy rating on the stock. He is highly bullish on the company’s prospects and predicts an upside of more than 30% in the share price.

Is Repsol Stock a Buy?

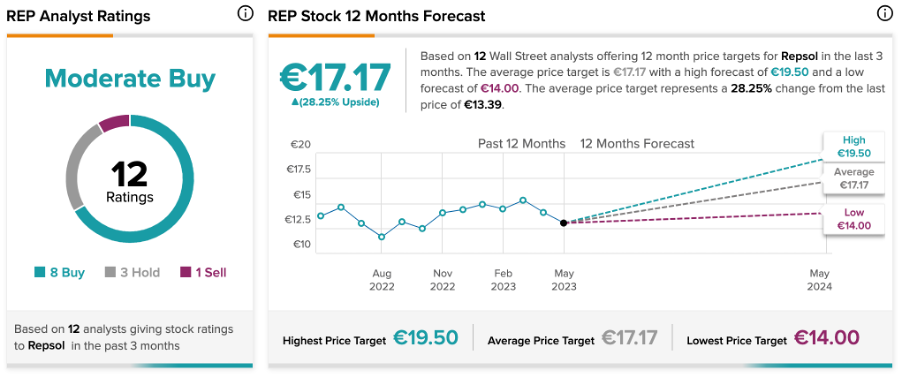

REP stock has a Moderate Buy rating on TipRanks, backed by a total of 12 recommendations, of which eight are Buy.

The average price target of €17.17 shows an upside of 28.2% from the current price level.

Banco Santander S.A. (Santander)

Santander is a leading banking institution in Spain, serving around 160 million customers. The company’s stock has gained around 24% in the last six months. For its first quarter of 2023, the bank posted higher profits, driven by improved levels of customer activity and strict cost control measures.

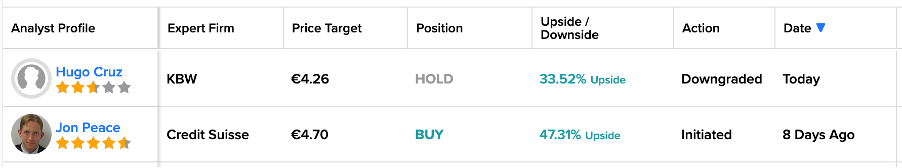

Today, KBW analyst Hugo Cruz downgraded his rating from Buy to Hold on the stock. The price target is set at €4.26, which represents a growth of 33.5% from the current level.

Eight days ago, Credit Suisse analyst Jon Peace initiated a Buy rating on the stock at a price target of €4.70. This implies an upside of 48% in the share price.

Is Banco Santander Stock a Buy?

SAN stock has a Moderate Buy rating on TipRanks, with seven Buy and five Hold recommendations.

The average target price is €4.67, which shows a growth of 46.77% from the current price level. The target price has a high forecast of €5.66 and a low forecast of €4.01.

Conclusion

Tracking analysts and the stocks they express bullish sentiments towards is undoubtedly a more secure approach to investing your money. Even though these two stocks have received mixed ratings from analysts, the potential growth in their share prices is surely attractive to investors.