The stock of Iberdrola S.A. (ES:IBE) has recently received Buy ratings from analysts, which suggests more upside potential in the share price. Yesterday, analyst Jose Ruiz from Barclays confirmed his Buy rating on the stock, forecasting a growth rate of 21%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This rating confirmation was mainly driven by the fact that the company informed investors yesterday that there is no necessity to record impairments in its offshore business. Iberdrola has confirmed that it has already finalized all pertinent supplier agreements for its forthcoming projects, and up to now, there have been no instances of delays.

Prior to this, two days ago, RBC Capital analyst Fernando Garcia also reiterated his Buy rating, predicting a modest upside of 9%.

The Iberdrola share price was down by 0.23% yesterday. YTD, the stock has gained 3.14% in trading.

Iberdrola is a global energy utility company focused on clean and sustainable energy solutions. For over two decades, the company has been dedicated to clean energy, aiming to surpass a renewable capacity of 52,000 MW by the year 2025.

Solid Earnings and Improved Outlook

In July, the company announced its half-yearly earnings for 2023. The net profit in the first half grew by 21.5% to €2.52 billion as compared to the first half of 2022. The increase in profits was a result of a 10% expansion in the company’s worldwide network asset base, which now stands at €40 billion, including investments worth €10.5 billion in the last 12 months. The adjusted EBITDA increased by 17% on a year-over-year basis to €7.56 billion.

Following the growth in earnings, the company raised its profit forecast to “high-single-digit net profit growth.”

Is Iberdrola Stock a Buy?

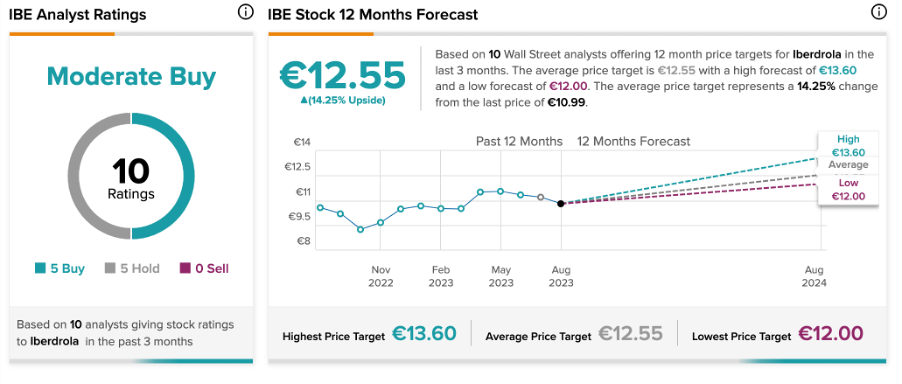

Based on a total of 10 Buy recommendations, IBE stock has received a Moderate Buy rating on TipRanks. The Iberdrola share price target is €12.55, which represents a favorable change of 14% in the share price.