In interesting news on Hong Kong stocks, Chinese smart electric vehicle (EV) maker XPeng Inc. (HK:9868) (NYSE:XPEV) and German auto giant Volkswagen AG (DE:VOW) are strategizing further to accelerate EV development in the mainland. The duo signed a “Master Agreement” for platform and software collaboration, allowing them to jointly source common parts and develop technology to fast-track EV manufacturing. 9868 shares rose 4% on the news in early trade this morning.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s How the Agreement will Help Both Companies

Joint sourcing of parts by leveraging Volkswagen’s solid supply chain is expected to provide high synergies of cost and enhance the competitiveness and efficiencies of the EVs that will be built by the two companies. Moreover, Volkswagen believes that the joint sourcing program will reduce the development time in the design and engineering phase by over 30%.

Interestingly, in July 2023, Volkswagen took a 4.99% stake in XPeng, with plans to manufacture two B-Class battery electric vehicles (BEVs) for Chinese consumers. The BEVs would carry the VW logo and feature a jointly developed platform based on XPeng’s G9 Edward technology.

The latest agreement further bolsters the collaboration between the two automakers. Volkswagen, particularly, has been losing out on the market share of its traditional gas-powered engine autos to EVs and plug-in hybrids in China, one of the largest single markets for the automaker. A partnership with XPeng will bolster the EV-making process and could improve Volkswagen’s prospects in China.

Ralf Brandstätter, a Board Member of Volkswagen AG for China, said the partnership “increases the competitiveness in a highly price sensitive market environment significantly.”

What is the Target Price for XPeng Stock?

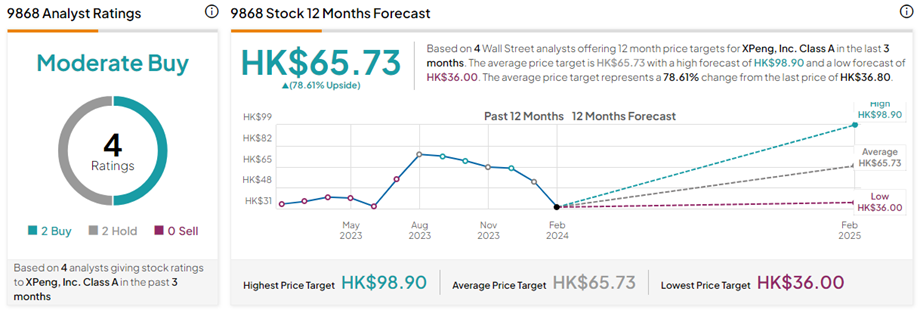

On TipRanks, the XPeng Inc. Class A share price target of HK$65.73 implies 78.6% upside potential from current levels. Further, 9868 stock has a Moderate Buy consensus rating based on two Buys and two Hold ratings.

Is Volkswagen a Safe Investment?

With six Buys, four Holds, and two Sell ratings, VOW stock has a Moderate Buy consensus rating on TipRanks. The Volkswagen AG share price forecast of €135 implies 7.1% downside potential from current levels.