Among the popular Hong Kong stocks, JD.com, Inc. (HK:9618) offers a promising upside potential of over 90% for investors. The company’s shares had a rough patch in the last 12 months, with a loss of 47%, triggered by the retail slowdown and macroeconomic concerns in China. Nonetheless, analysts hold a bullish stance on the company and predict a huge upside in the share price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

JD.com is a leading e-commerce platform in China, offering products such as electronics, home appliances, and groceries.

Let’s dive into some details.

Resilient Performance in 2023

Recently, JD.com reported its annual results for 2023, delivering better-than-expected numbers in the fourth quarter. In Q4 2023, revenue surged by 3.6% to $43.1 billion, surpassing analyst expectations. The growth in the top line was primarily driven by a 6.1% increase in electronics and appliances sales to $21.2 billion. Revenue for the full year grew by 3.7% to $152.8 billion.

Furthermore, the company declared an annual cash dividend of $0.76 per ADS (American Depositary Share), with payment anticipated on or around April 29, 2024.

DBS Remain Bullish

Post-results, analyst Tsz Wang from DBS reiterated his Buy rating on JD.com stock, predicting a huge upside of over 100%. Wang believes the company’s expansion into new categories like groceries and healthcare will drive further growth and also compensate for the loss in other categories. He expects the company’s revenue to grow at a CAGR of 6% annually from FY23 to FY25.

Additionally, Wang believes that the company’s robust logistics infrastructure sets it apart from competitors, enabling enhanced customer experiences and higher traffic to its marketplace. He anticipates adjusted earnings to increase by 12% annually from FY23 to FY25.

Is JD Stock a Good Buy Now?

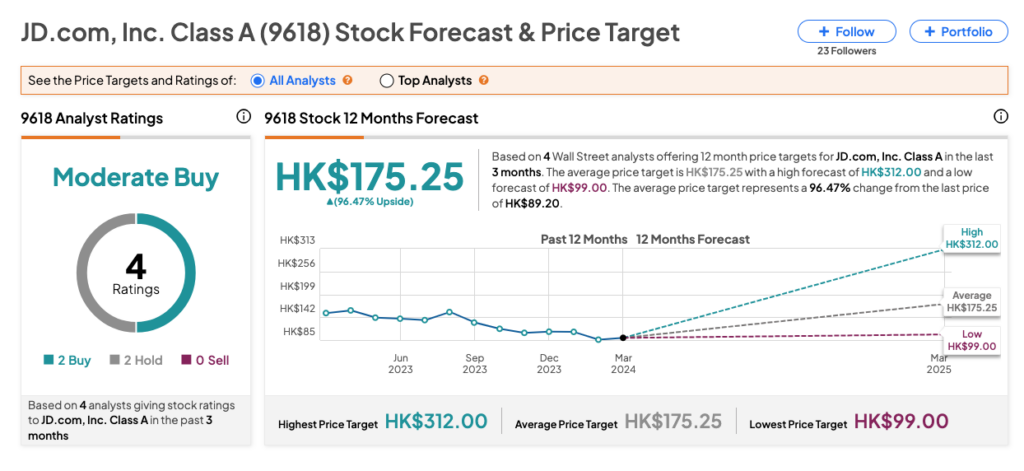

As per the consensus among analysts on TipRanks, 9618 stock has been assigned a Moderate Buy rating based on two Buy and two Hold recommendations. The JD.com share price target is HK$175.25, which implies an upside of 96.5% from the current price level.