Among the major Hong Kong stocks, NetEase (HK:9999) (NASDAQ:NTES) has received a thumbs-up from analyst Saiyi He from CMB International, driven by the company’s renewed deal with Blizzard Entertainment, part of Microsoft Corporation (NASDAQ:MSFT). CMB anticipates NetEase’s games and value-added services revenue to increase by 9% year-over-year to ¥89 billion in 2024. It expects the growth to reach double-digits in the second half, propelled by the reintroduction of Blizzard titles and the release of other game titles.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the last month, NetEase shares have lost over 12% in trading, with the stock now offering a more attractive entry point. Overall, the stock has been fluctuating amidst changes in Chinese regulatory policies over the last few months.

NetEase is a technology company specializing in the development of online PC and mobile games, smart devices, e-commerce platforms, and more.

The Return of NetEase-Blizzard Partnership

In 2022, Blizzard and NetEase failed to renew their agreement, leading to Chinese gamers losing access to Blizzard’s games in early 2023. With the renewal, NetEase anticipates increased revenue from publishing Blizzard’s highly popular games in China.

As part of this agreement, beloved titles like World of Warcraft, Hearthstone, and Diablo will mark a gradual return to China, beginning in the summer of 2024. Additionally, NetEase has struck a deal with Microsoft to bring its titles to Xbox and other platforms.

CMB’s Bullish Case

CMB expects the Blizzard games to push NetEase’s gaming revenue higher from the third quarter of 2024 onwards. According to CMB estimates, Blizzard gaming titles had an annual run rate of ¥3-5 billion in China in 2022. This is equivalent to 3-5% of NetEase’s estimated gaming revenues and 3-4% of its total revenue for Fiscal 2024.

CMB also remains upbeat about the overall gaming revenues of the company, based on the strong portfolio of existing and upcoming gaming titles. The already-launched SheDiao already has over 1 million downloads. Other anticipated titles include Naraka: Bladepoint Mobile, which is anticipated to be released in the second or third quarter of 2024, thus contributing to gaming revenue from the third quarter onward. Additionally, Where Winds Meet’s launch date is expected to be announced in April 2024.

Overall, CMB sees new games and the Blizzard partnership as potential catalysts for the share price growth.

Is NetEase a Good Stock to Buy?

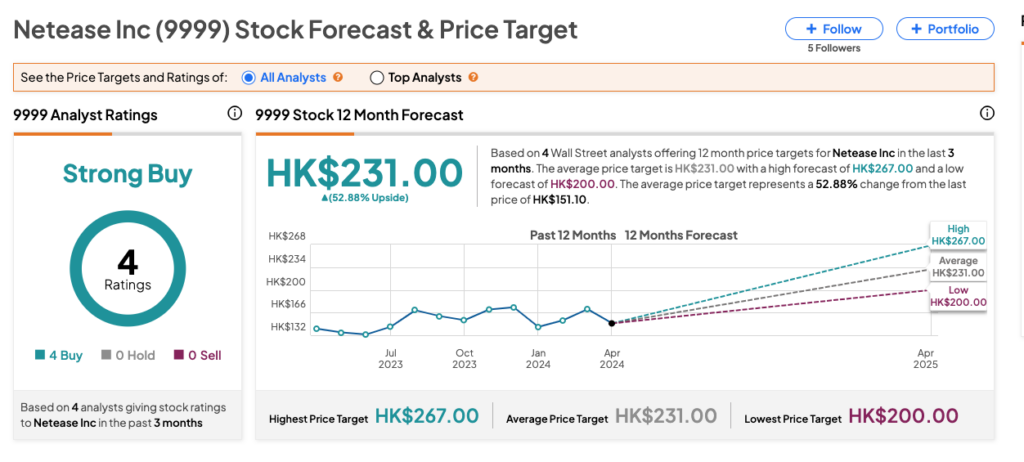

On TipRanks, 9999 stock has received a Strong Buy rating, backed by all four Buy recommendations. The NetEase share price target of HK$231 implies an upside of 52.9% from the current level.