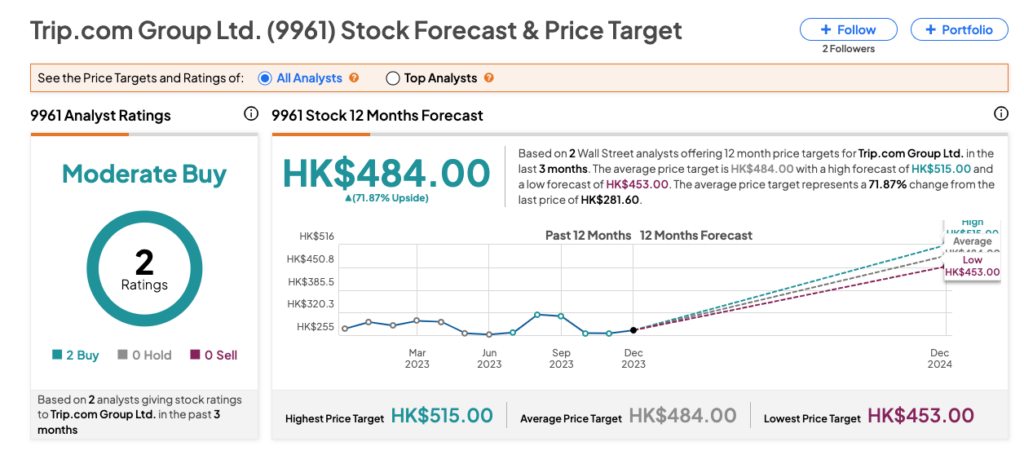

HKEX-listed Trip.com Group Limited’s (HK:9961) stock offers more than 70% upside potential, as per analysts’ average price target, making it an exciting opportunity for investors. The company is optimistic about the recovery in global travel demand after huge damage from the pandemic. In 2023, the stock traded down by 3.4%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Trip.com Group is the leading travel agency, offering services like hotel bookings, air tickets, holiday packages, etc.

Analysts Bullish on Trip.com

After its Q3 earnings report for 2023, analysts have a bullish stance on the company’s prospects and recommend buying the stock.

The company announced a 99% surge in revenue, reaching $1.9 billion in the third quarter. The robust growth was attributed to increased bookings for both domestic and international travel. Domestic hotel bookings experienced impressive growth, exceeding 90% year-over-year and surpassing pre-COVID levels by over 70%. Outbound hotel and air reservations rebounded to approximately 80% of the pre-COVID level.

Post-results, analyst Tsz Wang from DBS reiterated his Buy rating on the stock, predicting a huge upside of over 80%. Wang anticipates a CAGR of 17% in revenues from FY23 to FY25. Wang is bullish based on several factors, including “rising travel spend from mid-lower-tier cities and Gen-Z,” increasing solo travelling, and growing preference for adventure sports. The growth trajectory is also expected to be supported by international expansion and advertising income.

Three days ago, Jefferies analyst Thomas Chong also confirmed his Buy rating on the stock, forecasting a growth rate of 60%.

What is the Target Price for Trip.com?

As per the consensus among analysts on TipRanks, 9961 stock has been assigned a Moderate Buy rating based on two Buy recommendations. The trip.com share price target is HK$484, which implies an upside of 72% from the current price level.