Shares of ASX-listed Magellan Financial Group Ltd (AU:MFG) fell 7.4% in today’s trade following a downgrade by investment firm Citi. Analyst Christopher Kightley downgraded MFG stock to Sell rating from Hold in reaction to the company’s latest financial update. However, Kightley raised the price target on the stock to AU$8.1 from AU$7. Even so, the revised price target implies a 16% downside potential from Friday’s closing price of AU$9.65.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Magellan Financial is an Australian investment company that invests the funds of domestic retail and institutional clients. The company primarily invests in global equities and listed infrastructure funds to maximize investor returns. MFG shares have gained 10.9% in the past year.

Downgrade Follows Magellan’s Recent Financial Update

On January 5, Magellan released its funds under management (FUM) update for December 2023. As of December 29, Magellan’s total FUM stood at AU$35.8 billion, marginally higher than November’s figure of AU$35.2 billion. Importantly, Magellan witnessed net outflows of AU$200 million, reflecting net retail outflows of AU$300 million vis-à-vis net institutional inflows of AU$100 million. Further, the average FUM for the six months ending December 31, 2023, was AU$36.9 billion, drastically lower than the comparative prior-year period’s figure of AU$53.8 billion.

Magellan has witnessed a steady decline in FUM over the past few quarters. Institutional clients have withdrawn heavily from Magellan’s funds, resulting in a dip in its FUM. The company even appointed a new chairman to its board last year to revitalize its strategic course.

Kightley believes that the markets are getting overtly optimistic about MFG’s stock trajectory following the recent rally. The analyst noted that the modest rise in FUM in the most recent update is mostly attributable to the market’s performance rather than actual fund inflows. Further, Kightley is negative on the company’s 3 and 5-year horizons while also being cautious of its near-term FUM growth. All these factors have led the analyst to downgrade MFG to a Sell rating.

Is MFG a Good Buy?

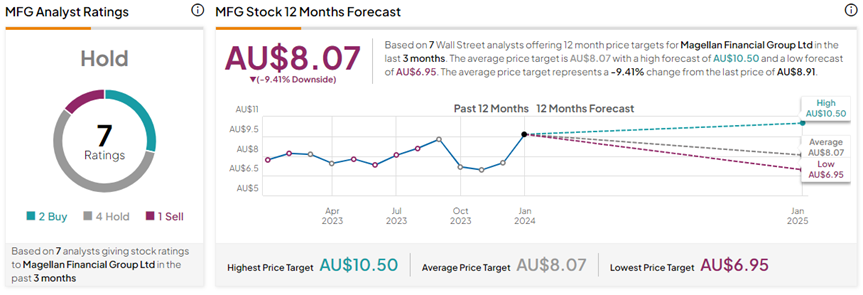

Overall, analysts are cautious about Magellan’s stock trajectory and prefer to wait on the sidelines. On TipRanks, MFG stock has a Hold consensus rating based on two Buys, four Holds, and one Sell rating. The Magellan Financial Group share price forecast of AU$8.07 implies 9.4% downside potential from current levels.