Shares of Australian miner Allkem Ltd. (AU:AKE) rose over 4% today following two positive announcements. First, Allkem signed the Impact Benefit Agreement (IBA) with the Grand Council of the Crees (Eeyou Istchee), the Cree Nation Government, and the Cree Nation of Eastmain regarding the development and operation of the James Bay Lithium Project. Further, Allkem received an additional US$50 million in financing from IDB Invest for the company’s Sal de Vida Project in Argentina.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Allkem explores and develops lithium deposits across Argentina, Australia, Canada, Chile, and the United States. It is the world’s largest producer of lithium carbonate and the fourth-largest producer of lithium hydroxide. Importantly, AKE’s share price could rise/fall further following a shareholder vote (scheduled for December 19) on the much-awaited Allkem and Livent Corporation (NYSE:LTHM) merger of equals.

Details of the Impact Benefit Agreement

The IBA, also called the Kapisikama Agreement, will help govern the relationship between Allkem and the Cree Nation through a sustainable development approach. The James Bay Lithium project is located in northern Quebec. The IBA would facilitate training, employment, business opportunities, and financial benefits for the Crees at the James Bay Lithium project.

Details of Additional Financing

Allkem announced that its Sal de Vida Project in the Catamarca Province in Argentina has received an additional US$50 million in financing from IDB Invest. The IDB funding supplements the US$130 million financing approved by the International Financing Corporation (IFC) in July this year. Notably, IDB Invest is a development bank ensuring the economic development of its member countries in Latin America and the Caribbean while IFC is a member of the World Bank Group.

Is Allkem Ltd a Good Buy?

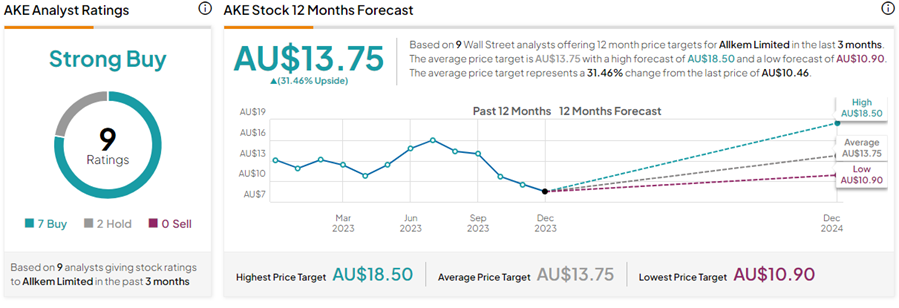

Recently, J.P. Morgan analyst Al Harvey cut the price target on AKE stock to AU$11 (4.6% upside) from AU$14.50 but maintained his Buy rating.

Overall, with seven Buys and two Hold ratings, AKE stock has a Strong Buy consensus rating on TipRanks. The Allkem Ltd. share price forecast of AU$13.75 implies 31.5% upside potential from current levels. Year-to-date, AKE shares have lost 4.8%.