British consumer healthcare company Haleon PLC (GB:HLN) will announce its half-yearly earnings tomorrow before trading hours. Analysts are foreseeing strong growth for Haleon in the first half, primarily attributed to impressive performances in the EMEA and Asia Pacific regions. Analysts have rated the stock as a Moderate Buy but with limited upside potential in the share price.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Haleon made its entry into the stock market in 2022 following its spin-off from GlaxoSmithKline PLC (GB:GSK). Since then, it has emerged as the top global consumer healthcare company. However, the share price has struggled and has gained just 9% as compared to its launch price.

First-Half Forecast Numbers

According to analysts, the forecasted EPS for the second quarter is £0.04 per share, similar to last year’s number. For the first half, revenues are expected to increase by around 8% to £5.6 billion. Among the regions, EMEA and Asia-Pacific are anticipated to experience growth rates of 10.4% and 10%, respectively, while the U.S. market is expected to show modest growth of 4.6%.

The company is well-positioned to attain a net profit of £797 million for the first half, along with an adjusted EBITDA of £1.316 billion, up from £1.306 billion recorded last year. Even though the earnings growth is not exceptional, it still speaks highly of the company’s performance during times of high inflation and increased pressure on consumer spending. For the full year, the earnings are expected to grow to £2.87 billion in 2023 and further to £3.02 billion and £3.19 billion in 2024 and 2025, respectively.

Analysts are mainly looking forward to the company’s growth in the Asia-Pacific region, with a strong portfolio of brands. Given the expanding middle-class population in developing markets, the demand for consumer-branded products is expected to increase, which augurs well for Haleon’s positive outlook.

What is the Target Price for Haleon?

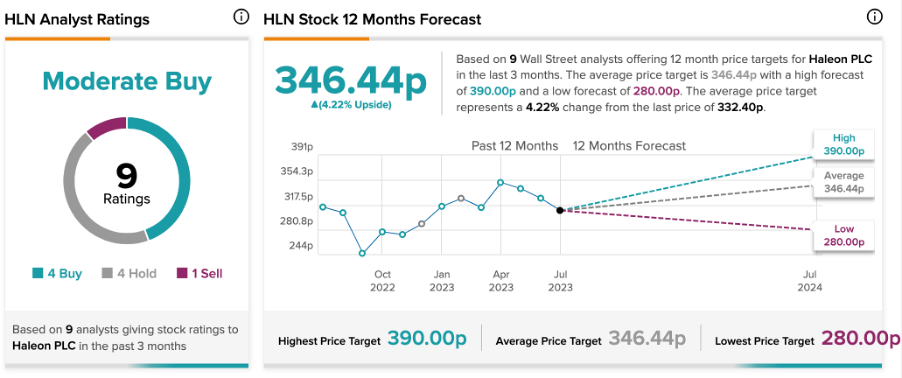

Based on a total of nine recommendations from analysts, HLN stock has a Moderate Buy rating on TipRanks. It includes four Buy, four Hold, and one Sell ratings.

At an average price target of 346.4p, analysts are predicting a growth of 4.2% in the share price.