Using TipRanks’ Smart Score tool for the UK market, we have shortlisted Haleon PLC (GB:HLN) and NatWest Group (GB:NWG) from the FTSE 100 index. These stocks have “Perfect 10” scores, which implies a higher potential to outperform the market returns.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This distinctive score evaluates stocks based on eight key factors to assess their potential for outperforming the market. Stocks with scores of eight, nine, and ten have a higher likelihood of exceeding market returns.

Let’s take a look at the details.

Haleon PLC

Haleon PLC holds the top position worldwide in major categories within the global consumer healthcare business. Haleon was created in July 2019 through the merger of GlaxoSmithKline’s (GB:GSK) and Pfizer’s (GB:0Q1N) consumer healthcare businesses.

In recent times, the company’s shares have displayed volatility, experiencing a downward trend of 3.48% in trading.

In May, GSK completed the sale of 240 million shares in Haleon at a price of 335p per share, reducing its stake to 10.3%. Similarly, Pfizer, which holds a 32% stake in Haleon, disclosed its plans to gradually divest that stake over the course of several months in a “slow and methodical” manner.

Analysts remain bullish on the stock considering its strong brand power, higher sales in 2022 earnings, and an even stronger outlook ahead. In 2023, the company aims to achieve sales growth ranging from 4% to 6%, improve margins, reduce debt, and increase investments in its brands.

Is Haleon Stock a Buy?

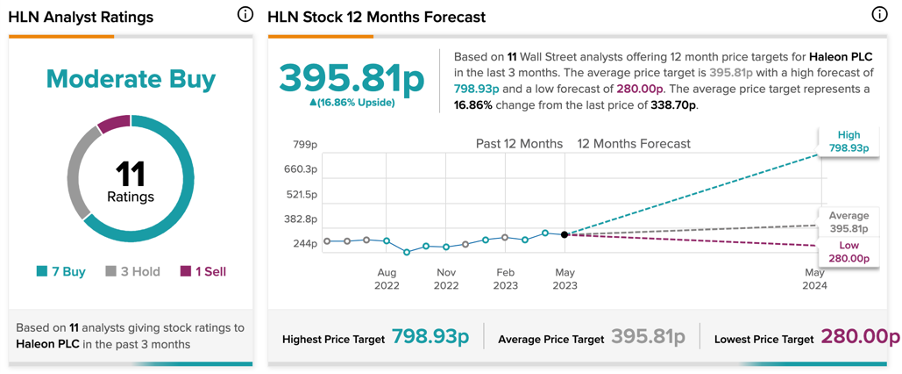

According to TipRanks, HLN stock has a Moderate Buy rating based on seven Buy, four Hold, and one Sell recommendations.

The average target price of 395.81p is 16.8% higher than the current price level.

NatWest Group

NatWest is positioned as one of the top four banking groups in the UK. YTD, the stock has been trading up by 4.17%.

Yesterday, the bank announced that it had reached an agreement to repurchase shares worth £1.3 billion from the UK government, marking a significant step towards returning to private ownership. This move will reduce the government stake to 38.69% from 41.4%, and it aims to complete the full transition of NatWest to private ownership by 2026.

Analysts feel this move was expected and doesn’t change the forecasts. Moreover, the reduction in government stake indicates significant progress in the bank’s strategic priorities and the journey toward privatization.

Are NatWest Shares a Good Buy?

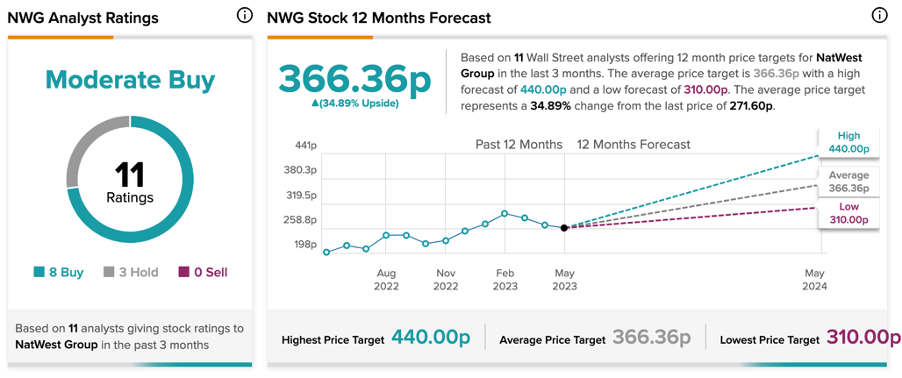

NWG stock has a Moderate Buy rating on TipRanks, based on a total of 11 recommendations, of which eight are Buy. At an average price target of 366.36p, the stock has an upside potential of 35% at the current trading levels.

Conclusion

Haleon and NatWest Group are both renowned names in their respective industries. With their Buy ratings from analysts and perfect scores on the Smart Score tool, these two stocks have the potential to be valuable long-term additions to an investment portfolio.