Shares of Spanish multinational pharmaceutical company Grifols SA (ES:GRF) cratered over 30%, hitting a fresh 52-week low of €8.10 on January 9 following short seller Gotham City Research’s accusations. The hedge fund has questioned the authenticity of Grifols’ financials, including its leverage ratio and EBITDA (earnings before interest tax depreciation and amortization). Grifols shares lost over $3 billion in market value yesterday on the news.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Spain-based Grifols collects plasma and then manufactures and sells plasma-derived products globally. Grifols also has smaller segments, including diagnostics, hospital supplies, and bio-supplies. The pandemic slowed down Grifols’ business as plasma collection had to be halted at the time. This led to a burgeoning debt burden on the company.

The company has tried to improve the situation through cost cuts and leadership change. GRF shares have lost 9.3% in the past year.

Gotham City Research’s Allegations

Gotham City Research focuses on due diligence-based investing and has long or short positions in the companies it covers. The U.S.-based hedge fund alleged that Grifols’ reported leverage ratio of 6x has been manipulated and should be close to 10x to 13x.

Furthermore, the short seller’s report mentioned that Grifols and a related family unit, Scranton Enterprises, fully consolidated the financials of BPC Plasma and Haema, which is incorrect and deceptive. Both units have been sold to Scranton and should not be consolidated by Grifols.

Based on these allegations, Grifols is poised to face significantly higher financing costs in the future. Gotham believes the high leverage would bring Grifols’ share value to zero, making the stock uninvestable.

Grifols’ Justifications

On its part, Grifols has denied any manipulation of its financials and informed Spain’s market regulator CNMV that the report holds “false information and speculation.” After a thorough discussion with the board members yesterday, Grifols is expected to release a new statement today to address the allegations.

Grifols also stated that the hedge fund speculated that the deal to sell the company’s 20% stake in Chinese unit Shanghai RAAS Blood Products for $1.8 billion would fall apart.

Moreover, Grifols argues that Gotham City Research could have a short position on its shares, prompting it to put out the allegations to impact GRF’s share price. In such a case, a fall in the value of GRF shares would help the hedge fund make profits on short selling.

Is Grifols Stock a Good Buy?

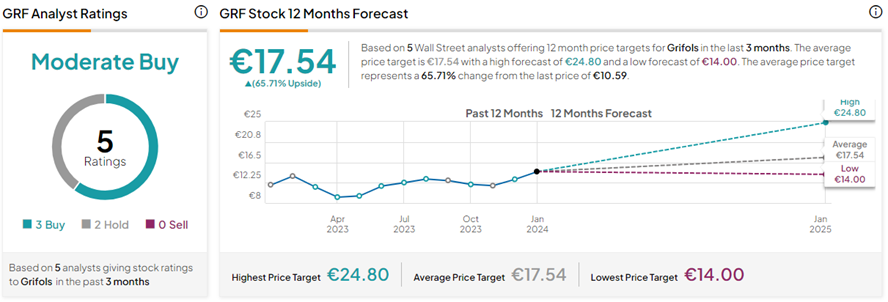

With three Buys versus two Hold ratings, GRF stock has a Moderate Buy consensus rating. On TipRanks, the Grifols SA share price target of €17.54 implies 65.7% upside potential from current levels.