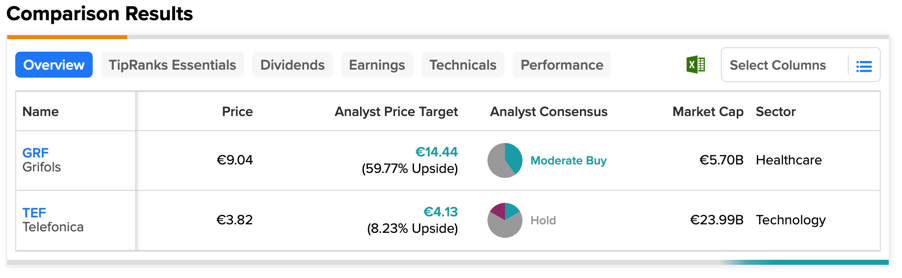

Today, we have chosen two companies from the Spanish market: the telecom behemoth Telefonica (ES:TEF) and the healthcare provider Grifols (ES:GRF). Grifols has a Moderate Buy rating from analysts, whereas Telefonica carries a Hold rating on TipRanks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Users can benefit from the TipRanks Stock Comparison tool, which is the perfect way to compare two stocks within the same market. This tool offers various parameters such as target price, analyst ratings, market capitalization, dividends, etc to analyze these stocks and choose the right one.

What is Grifols Stock Price Forecast?

Grifols is a healthcare company developing plasma-derived medicines and solutions.

The company’s stock has lost around 20% of its value since the beginning of this year. This was mainly pushed down after the company announced the lay-off of more than 8% of its workforce to achieve its target of cost savings of €400 million annually.

According to TipRanks, GRF stock has a Moderate Buy rating, based on two Buy and three Hold recommendations.

The average target price is €14.44, which implies an upside of almost 60% from the current price. The target price has a high and a low forecast of €17.8 and €10.0, respectively.

Telefonica S.A.

Telefonica is a telecommunications company, well-recognized for its speed and network in Europe and the U.S.

Contrary to GRF stock, Telefonica has gained more than 10% YTD. Analysts don’t’ forecast any significant upside in its stock price but see it as perfect for income investors. The company has a dividend yield of 6.9%, as compared to the industry average of 1.025%. The company proposed a dividend of €0.30 per share for 2022 and also for 2023.

On TipRanks, TEF stock has a Hold rating based on a total of six recommendations.

The average target price of €4.13 is 8.2% higher than the current price.

Conclusion

Both GRF and TEF are good options for a balanced portfolio of investors. On one hand, Grifols provided higher share price appreciation with an upside of 60%. Telefonica, on the other hand, is more suitable for income investors with stable dividend payments.