Shares of Spanish multinational pharmaceutical company Grifols SA (ES:GRF) gained nearly 12% yesterday on news that it was planning to sue American short seller Gotham City Research. Grifols said it will claim compensation amounting to at least the share price loss on January 9 and seek to clear its name, given the reputational damage caused by the short seller’s allegations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Grifols collects plasma and then manufactures and sells plasma-derived products globally. Grifols also has smaller segments, including diagnostics, hospital supplies, and bio-supplies. GRF shares lost 2.6% in the past year, primarily due to the 26% plunge on January 9.

Here’s More on Grifols’ Plans

On January 8, Gotham City Research released a report accusing Grifols of financial and accounting manipulation and reducing its leverage to 6x when it should be between 10x and 13x. The allegations sent Grifols shares plunging, wiping nearly €2.2 billion off the stock’s market capitalization in a single day.

Grifols “categorically” denied any financial malpractices following the report and scheduled a board meeting on Wednesday. It was then that board members decided to sue Gotham City Research. The details of when and where the lawsuit will be filed remain unknown at the time. Grifols said it will hold a conference call with shareholders today. The board is also fully supporting the newly instated CEO, Thomas Glanzmann.

Spain’s market regulator CNMV had said on Tuesday that it makes no sense to doubt Grifols’ audited accounts. Meanwhile, CNMV will verify the facts of the allegations and clarify the matter. Short sellers usually bet against a company and benefit from any negative news that sends the share price down.

Is Grifols a Buy, Sell, or Hold?

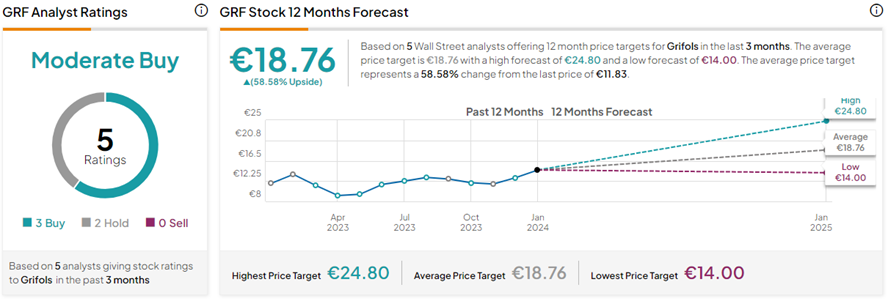

Following the short seller report, Citi analyst Peter Verdult reiterated a Buy rating on GRF shares with a price target of €23.00, implying a massive 94.4% upside potential from current levels.

Overall, with three Buys and two Hold ratings, GRF stock has a Moderate Buy consensus rating. On TipRanks, the Grifols SA share price forecast of €18.76 implies 58.6% upside potential from current levels.