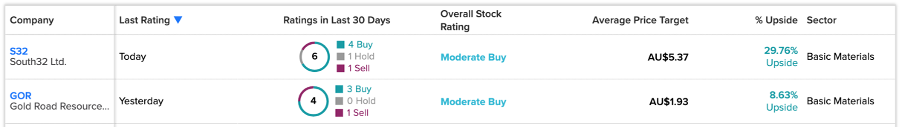

ASX-listed mining companies South32 Ltd. (AU:S32) and Gold Road Resources Ltd. (AU:GOR) have recently been rated Buy by analysts. Overall, both stocks have Moderate Buy ratings on TipRanks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Here, we have used the TipRanks Trending Stocks tool for the Australian market to screen stocks that have been recently rated by analysts. This tool comprises all the companies within a particular market that have been rated or re-rated by analysts over the last 30 days.

Let’s have a closer look at these companies.

South32 Limited

South32 is an Australian mining company with a portfolio of diversified metals like coal, manganese, nickel, silver, and many more.

The company’s stock tumbled around 9% yesterday after the company announced production numbers for the quarter ended in March 2023. The numbers were down as the mining sites were hit by floods and wet weather disruptions during the quarter, leading to lower production. The company also reduced its production guidance for 2023 for Mozal aluminum by 8%, Cannington by 6%, and nickel by 7%.

On the plus side, the company was able to increase prices for most of its commodities, especially for its coal and manganese products.

The stock has seen a lot of action from analysts in the last few days. Today, analyst Alexander Hislop from RBC Capital reiterated his Buy rating on the stock at a price target of AU$8.4. This implies a huge upside of more than 100% at the current trading levels.

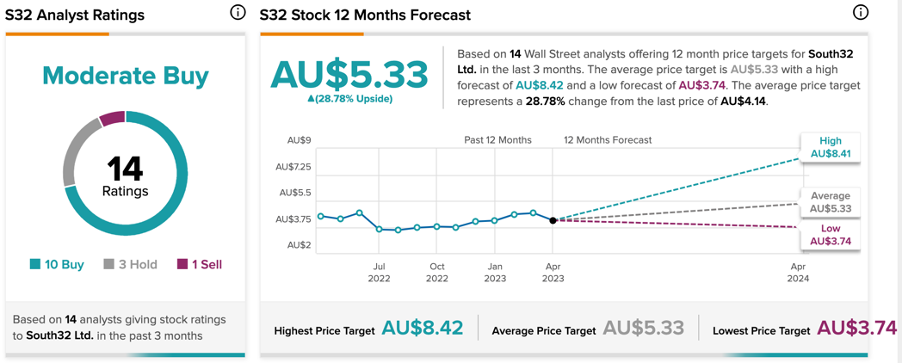

Is South32 a Good Share to Buy?

Based on 10 Buy, three Hold, and one Sell recommendations, S32 stock has a Moderate Buy rating on TipRanks.

The average target price is AU$5.33, which shows a growth of 28.7% from the current price level.

Gold Road Resources Limited

Gold Road is a gold producer in Australia and owns tier 1 and exploration projects in the country. Over the last six months, the stock has made its shareholders happy with almost 35% returns.

Yesterday, Gold Road also announced its quarterly report with production and guidance numbers. The total gold production of 82,604 ounces during the March quarter was higher than the December quarter figure of 74,201 ounces. The total gold sold during the quarter was done at a higher average selling price of AU$2,764 per ounce, as compared to AU$ 2,476 per ounce in the previous quarter. The company kept its 2023 guidance unchanged at between 3,40,000 and 3,70,000 ounces.

After such solid quarter numbers, analyst Tim McCormack from Canaccord Genuity reiterated his Buy rating on the stock. His price target of AU$2.20 implies an upside of 24% on the current share price.

Six days ago, UBS analyst Lachlan Shaw also confirmed his Buy rating and predicted an upside of more than 30%.

Is Gold Road Resources a Good Buy?

According to TipRanks, GOR stock has a Moderate Buy rating, based on five Buy and one sell recommendations.

The average price target is AU$1.93, which is 8.74% higher than the current price.

Conclusion

Both South32 and Gold Road announced their quarterly reports yesterday, which attracted analysts’ attention to their stocks. The analysts remain bullish on the production and guidance numbers and have rated the stocks as Buy.