UK-based miner Glencore PLC’s (GB:GLEN) first-half earnings for 2023 were hit hard as soaring commodity prices declined and normalized from record levels from the last year. The company’s profits experienced a 50% reduction, yet the shareholders’ returns and dividends painted a pretty picture

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following the release of the results, the shares went down by 2.66% yesterday. After a prosperous three-year trading period, the stock began this year with a decline. YTD, the shares have encountered a 15% loss in trading.

Let’s take a look at the numbers.

Half-Yearly Numbers

The company’s revenues of $107 billion were down by 20% during the first six months, as compared to $134 billion generated in the same corresponding period last year. The core earnings (adjusted EBITDA) were down by 50% to $9.4 billion. This fell short of analysts’ estimates of $9.9 billion from Deutsche Bank and $11.4 billion from Citi. The substantial surge in profits in the previous year, driven by record-setting energy prices resulting from Russia’s invasion of Ukraine, has now eased.

Moreover, the combination of inflationary trends, stricter monetary measures, and constrained economic activities has led to lower prices of copper, cobalt, nickel, and zinc by 11%, 59%, 13%, and 26%, respectively, as compared to last year. The company also felt the impact of reduced volatility in its trading division.

The net income attributable to shareholders also decreased by 61% to $4.6 billion. Talking about the shareholders’ returns, the company announced additional returns amounting to approximately $2.2 billion in its results. It includes a special dividend of $1 billion and a share buyback program of $1.2 billion.

Following the Competitors’ Way

The company joined its counterparts, Rio Tinto Group (GB:RIO) and Anglo American PLC (GB:AAL), in reporting lower earnings due to weaker commodity prices. Rio posted a 43% drop in its net earnings of $5.1 billion in the first half of 2023, as compared to $8.9 billion in the same period of 2022. The company’s numbers were down mainly due to falling iron ore prices, which contribute to the majority of its profits.

Likewise, Anglo-American experienced a 41% drop in its underlying earnings, amounting to $5.1 billion in the first half, attributed to macroeconomic challenges and subdued product prices.

Is Glencore a Good Share to Buy?

In terms of share price growth, analysts are still optimistic about the company’s stock. Yesterday, analysts from Jefferies and Deutsche Bank reiterated their Buy ratings on the stock, predicting more than 20% upside.

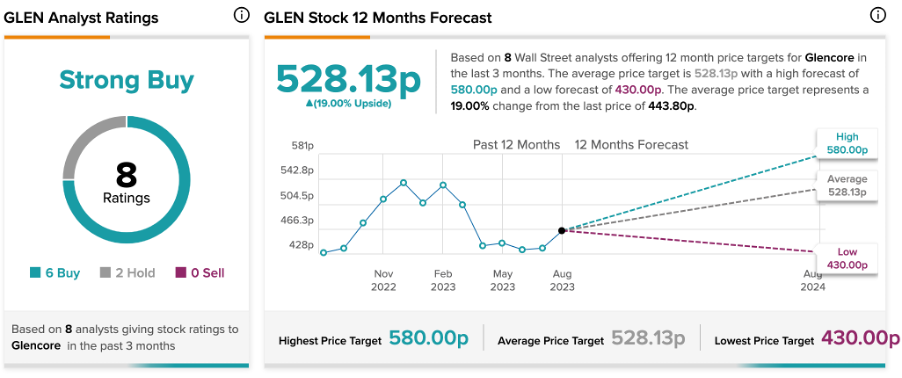

Based on the analyst consensus from TipRanks, GLEN stock has received a Strong Buy rating, supported by a total of eight recommendations. This includes six Buy versus two Hold ratings.

At an average target price of 528.13p, analysts are projecting a growth of 19% from the current level.