SGX-listed leisure company Genting Singapore Limited (SG:G13) has earned a Strong Buy rating from analysts who remain upbeat about the company’s outlook. After the company released its Q3 2023 earnings report earlier this month, many analysts confirmed their Buy ratings on the stock, predicting more growth in the share price. Looking ahead, analysts express a bullish perspective on the company and its stock, driven by the continued recovery of travel and tourism, as reflected in its Q3 numbers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Genting Singapore is an investment holding company actively involved in the development of resort and casino properties. The company plays a prominent role in the realms of leisure, hospitality, and integrated resort ventures in Asia.

Q3 2023 Results

In its third quarter, which ended in September 2023, the company achieved a net profit of S$216.3 million, marking a notable 59% increase year-over-year. The quarter saw a substantial increase of 33% in revenue, reaching S$689.9 million, up from the S$519.7 million reported last year. Among its segments, the Gaming business contributed S$459.6 million, marking a 20% increase, while Non-Gaming revenue grew by 68% to S$230.1 million.

The company also announced an expansion spend of S$6.8 billion, exceeding analysts’ estimates.

Recent Ratings

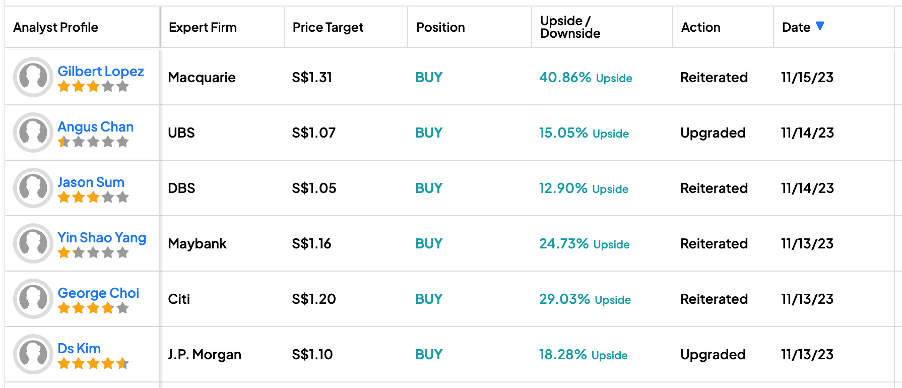

Most recently, analyst Gilbert Lopez from Macquarie reiterated his Buy rating on the stock, predicting a growth rate of 41%. Lopez has set the highest price target for Genting stock at S$1.31 per share.

In light of the favourable results, various analysts have upheld their Buy recommendations this month, foreseeing additional upside potential. Indeed, they view the company as strategically positioned to leverage the expected increase in air capacity and tourism influx to Singapore.

DBS analyst Jason Sum also maintained his Buy rating on the stock, forecasting a 13% increase in the price. Sum believes the near-term outlook for the company is promising, with higher expected tourists at Resorts World Sentosa (RWS). He added, “pent-up demand should also translate to higher spending per visitor.”

Analysts also maintain a cautious stance over the increased capital expenditure that might impact the longer-term return on capital.

Is Genting Singapore a Good Buy?

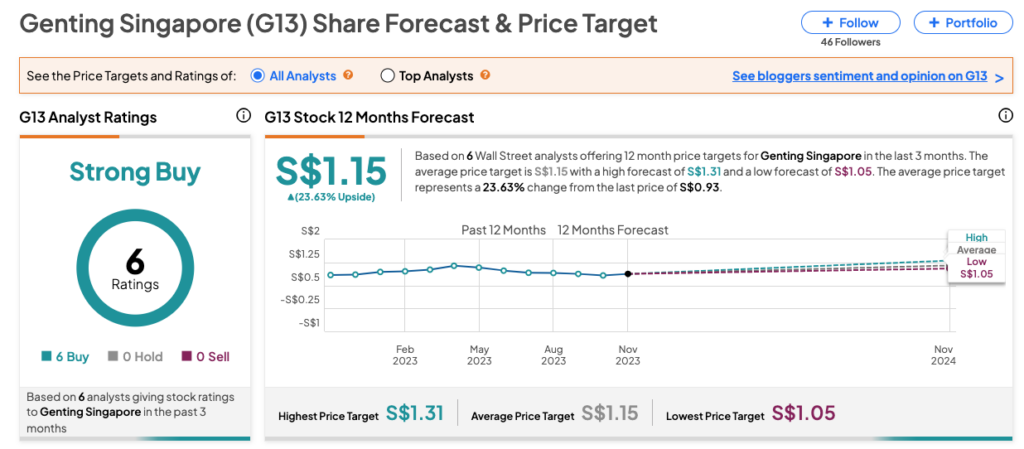

G13 stock has received a Strong Buy rating on TipRanks, backed by unanimous Buy recommendations from six analysts. The Genting share price target is S$1.15, which is 24% higher than the current trading level.