Games Workshop Group PLC’s (GB:GAW) stock declined by 14% on Thursday after the company released its half-yearly trading update for fiscal year 2023-24. The company stated that its performance since its last update in September has remained in line with expectations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company expects its core revenues to be a minimum of £235 million, compared to £212.3 million posted for the same period last year. The profit after tax is expected to be at least £94 million, which is above the £83.6 million reported a year ago.

Based in the UK, Games Workshop designs and manufactures miniature wargames. The company is known for its flagship product, Warhammer 40000, which is the most popular wargame in the world.

Why Did the Share Price Decline?

Games Workshop’s outlook for its licensing business generated from the intellectual property is a bit gloomy. According to the update, the estimate for the licensing revenue is down from £14.3 million to £12 million. Similarly, the operating profit for the licensing business is also projected to reduce from £12.9 million to £11 million.

This could be one of the reasons that disappointed investors, resulting in the decline in GAW’s share price. The slowdown in the demand for its supplementary products could be an early warning sign for other categories.

Additionally, as part of its profit share scheme, the company declared a cash amount of £2,500 for all its employees. This equates to a total payment of £7.5 million, up from £4.5 million a year earlier. While this step ticks the box for employee motivation, it could have been a worrying point for some investors, considering the lower cash reserves available for dividends.

Games Workshop will publish its first-half results on January 9, 2024.

Is Games Workshop a Buy or Sell Stock?

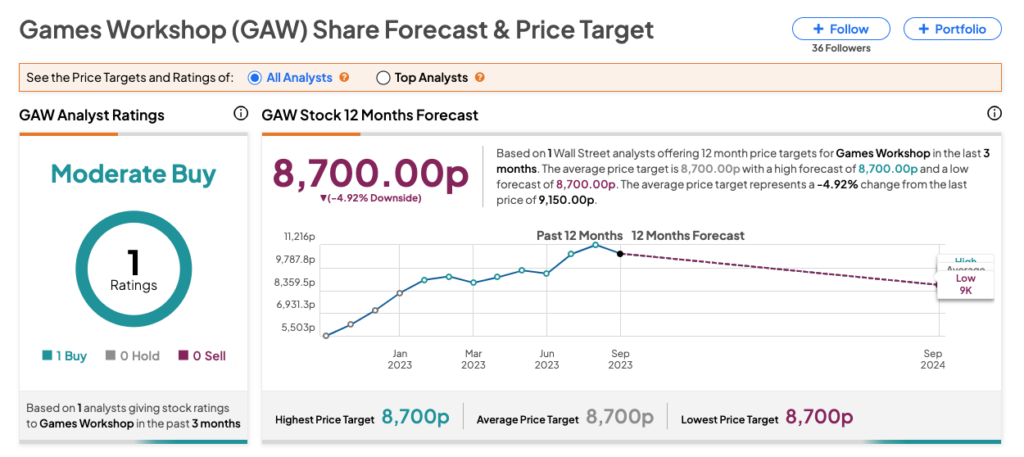

According to TipRanks, GAW stock has a Moderate Buy rating based on one Buy recommendation from Jefferies analyst Andrew Wade. He confirmed his Buy rating on the stock yesterday after the update.

Wade’s share price target for Games Workshop is 8,700p, which is 5% lower than the current trading level.