On Friday, the China-based global conglomerate Tencent Holdings Limited (HK:0700) (TCEHY) unveiled its new game, Last Sentinel, to establish its dominance in the console market. It is a big-budget console game that is being seen as the most ambitious game so far by the company.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tencent Holdings is a leading tech conglomerate catering to over 1 billion users. The company owns ground-breaking products like WeChat and QQ and holds a prominent position in the global video game industry.

More on Last Sentinel

Tencent launched a preview for the Last Sentinel action game during the Game Awards in Los Angeles. It is currently in development at the company’s Lightspeed LA gaming studio, with around 200 staff at work. The exact launch date for the game is yet to be announced.

Last Sentinel is an open-world sci-fi action game set up in a futuristic Tokyo. With this game, the company’s goal is to revolutionize gaming through creativity, enhancing user experiences.

Tencent Targets an International Audience

Over the years, Tencent’s global expansion has primarily involved investments in companies beyond China. However, it is now intensifying its overseas presence through its most profitable sector, video games. In the last two years, the company has expanded its highly successful gaming studios, TiMi and Lightspeed, globally.

The company’s most popular game, PUBG, owes its success to Chinese players, but with Lightspeed, it is now targeting an international audience. Apart from China and the U.S., Lightspeed has established offices in France, Japan, the UK, South Korea, and more.

Is Tencent a Buy or Hold?

Despite the big announcement, the share price traded down by 0.71% to HK$305.60 today, as one of the major shareholders, Prosus NV, sold around 513,500 shares in the company on Thursday. After this sale, Prosus currently holds 24.99% of Tencent. Investors were wary of the possibility of additional selling, contributing to the negative sentiment.

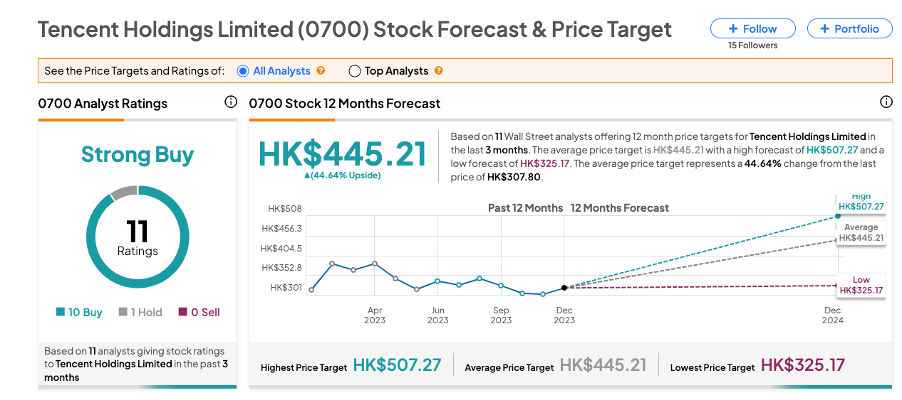

According to TipRanks’ rating consensus, 0700 stock has received a Strong Buy rating, backed by ten Buys and one Hold recommendation from analysts. The Tencent share price forecast is HK$445.21, which implies an upside of almost 45% on the current trading level.