FTSE 250 constituent airline easyJet PLC’s (GB:EZJ) share price has lost more than 4% in trading over the last five days. The shares breached the 500p threshold this year, marking a 24% increase YTD. However, the shares have witnessed a decline of more than 15% in the past six months and are currently trading at around 400p.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

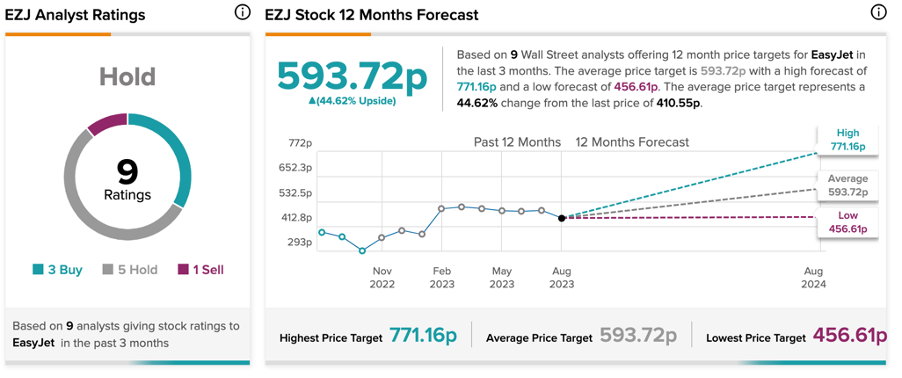

Overall, easyJet shares have received a Hold rating from analysts on TipRanks, but they still offer over 40% upside to investors. Considering its robust growth potential within the flourishing European travel sector, analysts have established a price target that reaches above the 700p mark.

easyJet holds a prominent position as a Europe-based airline recognized for its low-cost services. The company maintains a fleet of over 300 aircraft, with operations across 34 countries.

The Improving Numbers

In July, the company delivered impressive numbers in its Q3 2023 trading update and is forecasting record performance for Q4.

The company delivered a headline pre-tax profit of £203 million, which reflects a significant improvement of £317 million over Q3 2022. Passenger growth was up by 7% on a year-over-year basis, driven by higher demand for its services.

The company posted a pre-tax profit of £49 million, which is expected to grow to over £100 million in 2023.

A notable year-on-year increase of 23% in revenue per seat, coupled with a 2% reduction in headline cost per seat excluding fuel, is propelling the group towards a robust performance for FY23. easyJet is also looking forward to further reductions in fuel costs later this year, accompanied by a projected 10% increase in revenue per seat in Q4.

easyJet Share Price Forecast

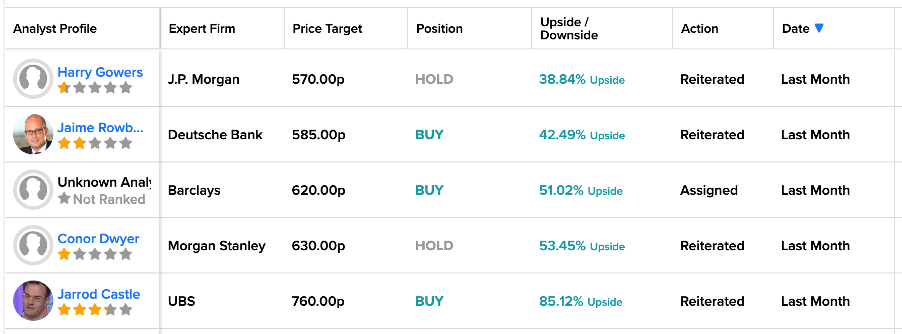

Over the last month, analysts also expressed their bullish outlook on the stock after the Q3 update. Analyst Jarrod Castle from UBS has the highest price target of 760p on the stock, which implies an upside potential of 85% in the shares. He confirmed his Buy rating last month.

As per the consensus among analysts on TipRanks, EZJ stock has been assigned a Hold rating. The company’s ratings consist of nine evaluations, including three Buy, five Hold, and one Sell recommendations.

The average easyJet share price target is 593.7p, with a high and a low forecast of 771p and 456.6p, respectively. This price target signifies a potential shift of 44.6% from the present share price.

Ending Notes

The company is optimistic about the winter holiday sales, which are exhibiting growth of over 100% compared to the corresponding period last year. The company has added another 15% of additional capacity to manage this high winter demand. The short-term outlook remains strong.