FTSE 250 company Harbour Energy PLC (GB:HBR) today reported heavy losses in H1 2023 due to a setback from the windfall tax imposed by the UK government. The taxes imposed on the oil and gas companies have led to lower investment across the North Sea and could further hamper production levels in 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The windfall tax, imposed by the UK government in May 2022 on oil and gas companies, has nullified the upswing in profits. Yesterday, another North Sea-based oil and gas producer, Ithaca Energy PLC (GB:ITH), also revised its production outlook downward, hit by reduced investments as compared to previously provided guidance. Ithaca announced its first-half results for 2023 yesterday.

Following the announcement, the shares were trading in the red zone and had lost over 2% today at the time of writing.

Higher Losses, Weaker Outlook

During the first half, the company reported revenues slightly exceeding $2 billion, a decrease from $2.67 billion in the previous year, primarily due to diminished oil and gas prices. In terms of profits, the company transitioned from nearly achieving a $1 billion profit last year to incurring an $8 million net loss in the first half of 2023. Pre-tax profit also declined drastically, from $1.49 billion last year to $429 million this year.

Moving forward into the second half, Harbour Energy has cut its production and capex (capital expenditure) guidance for 2023. The company has revised its production projection for this year to a range of 185,000 to 193,000 barrels of oil equivalent per day (kboepd), shifting from the previous estimate of 185,000 to 200,000 kboepd. The company also reduced the total capital expenditure by $100 million to $1 billion.

On the brighter side, the company is committed to capitalizing on its operational control and scope to achieve cost efficiencies. As part of this effort, it is projecting annual savings of approximately $50 million from 2024 onwards, after accounting for a one-time charge of $16 million recorded in the first half.

Are Harbour Energy Shares a Good Buy?

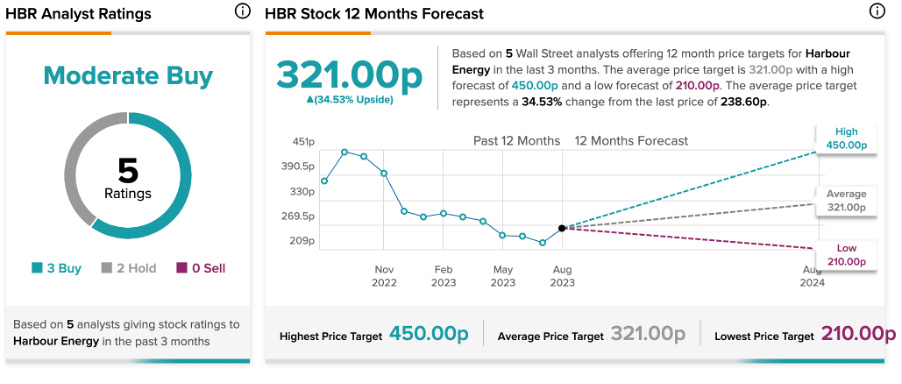

On TipRanks, HBR stock has a Moderate Buy rating based on three Buy versus two Hold recommendations. The average target price of 321p implies an upside of 34.5% from the current trading level.

It’s worth highlighting that these ratings were assigned well before today’s results, and additional updates are anticipated from analysts in the future.