The FTSE 250-listed Bellway PLC (GB:BWY) witnessed a more than 3% gain in its share price on Tuesday, despite the company providing a downbeat outlook for the next fiscal year. The company posted a decline of 18% in its pre-tax profits of £532 million in its preliminary results for the year that ended on July 31, 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company completed around 10,945 homes during the year, down from 11,198 homes in 2022. The overall selling price also fell from £314,399 in the last year to £310,306 in 2023. As a result, revenues were down by 3.7% to £3.4 billion. For FY24, the company expects its house completion rate to further decline by 31% to 7,500 homes as the higher interest rates put pressure on consumer demand.

Nonetheless, the company managed to maintain its final dividend at 95p per share, leading the total dividend for the year to 140p per share, similar to last year’s payment.

Are Bellway Shares a Good Buy?

The Bellway share price traded up by 3.31% yesterday as analysts continued to favour the results. In 2023, the stock has performed the best in its sector, gaining 16% year-to-date.

Analysts stated that the numbers were in line with expectations. UBS analyst Marcus Cole confirmed his Buy rating on the stock, stating that the stock is trading at a discount based on “the past year’s reported tangible net asset value.”

Analyst Sam Cullen from Peel Hunt remains bullish on the long-term prospects of the company. He is optimistic about the company’s balance sheet position and land investments and believes it will be the first to recover “when demand improves.”

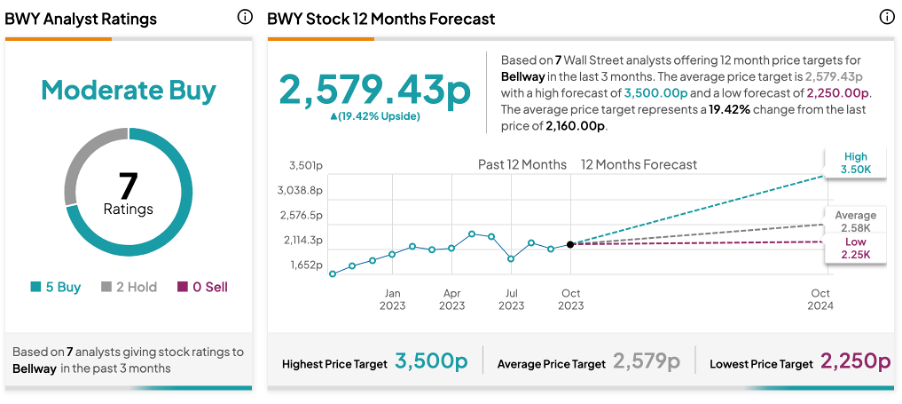

BWY stock has received a Moderate Buy rating on TipRanks, backed by five Buy and two Hold recommendations. The Bellway share price forecast is 2,579.43p, which is 19.4% higher than the current trading level.