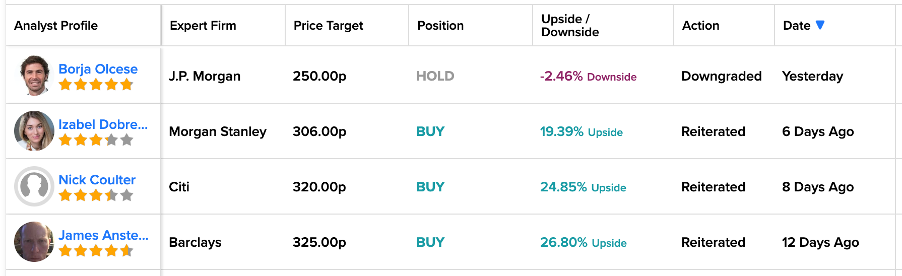

The share price of the British food retailer Tesco PLC (GB:TSCO) fell by over 2% yesterday after J.P. Morgan downgraded its rating on the stock. This was a part of the sector-wide downgrade of the European food industry in response to the anticipated risks of deflation in 2024. JP Morgan analyst Borja Olcese downgraded the rating on Tesco’s stock from Buy to Hold at a price target of 250p. This implies a downside of 2.46% at the current trading levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The investors reacted to the news, and the Tesco share price went down by 2.7% yesterday. Overall, the stock has been trading in the green zone, with a gain of almost 15% YTD.

Tesco is among the leading retailers in the UK, providing groceries and general products. The company conducts its operations through a variety of store formats and also maintains an online presence.

Deflation Risks Ahead

J.P. Morgan remains cautious about the food retail sector, as it believes grocery price deflation will pose risks to these companies in 2024. Olcese mentioned that deflation is a “real possibility” and something that is not entirely considered in share price predictions. He also stated that the current valuation is not attractive for investors and anticipates that the company’s profits as well as cash flow may deteriorate.

Among the list of retailers, Olcese believes UK-based B&M European Value Retail SA (GB:BME) is also highly exposed to these risks. Consequently, he downgraded his rating on the BME stock from Buy to Sell. The B&M share price target of 597.3p suggests a potential decrease of 6.4% from its current value.

Is Tesco Share a Good Buy?

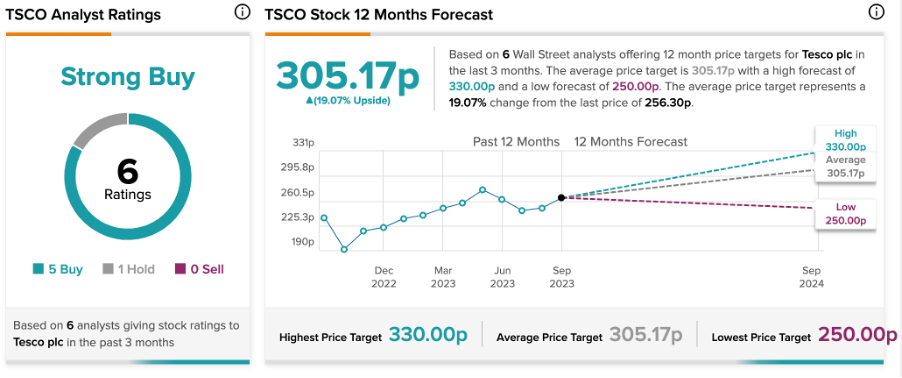

Contrary to Olcese, other analysts hold a bullish view regarding TSCO stock, as evidenced by its Strong Buy rating on TipRanks. This includes five Buy and one Hold recommendations.

Six days ago, Morgan Stanley’s analyst Izabel Dobreva reiterated her Buy rating on the stock, predicting an upside of 19.3% in the share price.

Similarly, analysts from Citigroup and Barclays also confirmed their Buy ratings recently, forecasting growth of 25% and 27%, respectively.

The average Tesco share price prediction is 305.17p, which is higher than the current trading levels and implies a change of 19%.