The share price of the FTSE 100-listed Rentokil Initial PLC (GB:RTO) crashed yesterday after the pest control company flagged weaker demand in North America in its Q3 update. The company highlighted the challenges in its wholesale chemical business in the U.S. due to overall economic conditions and reduced consumer demand.

It further stated that acquiring new customers was difficult as higher borrowing costs have limited consumers’ willingness to move houses. Rentokil expects its full-year performance in the region to be “marginally below” compared to its earlier projections.

On Thursday morning, the stock experienced a significant drop, plummeting as much as 20%, and ended the day with a loss of 17.6%. Over the last three months, the stock has been trading down by over 20%, triggered by the release of its first-half earnings report for 2023 in July.

Q3 Trading Update

Overall, the company delivered a growth of 60% (at constant exchange rates) in its revenues of £1.4 billion in the third quarter. This was mainly driven by its acquisition of Terminix and organic revenue growth of 4.3%. While North American organic revenue increased by 2.2%, the U.S. wholesale distribution business experienced a decline of 2.5% in Q3. The company’s second-largest region, Europe, registered a revenue growth of 9.5%, followed by 8.9% in Asia and MENAT (Middle East, North Africa, and Turkey).

Among its categories, Pest Control witnessed a 3.8% increase in organic revenue (total revenue grew by 81.2% due to the Terminix acquisition). The strong performance in other regions in Pest Control compensated for the slowdown in the U.S. market.

For the full year, the company now expects its North America unit’s adjusted operating margin to be in the range of 18.5% to 19%, down from the earlier forecast of 19.5%.

Is Rentokil a Good Stock?

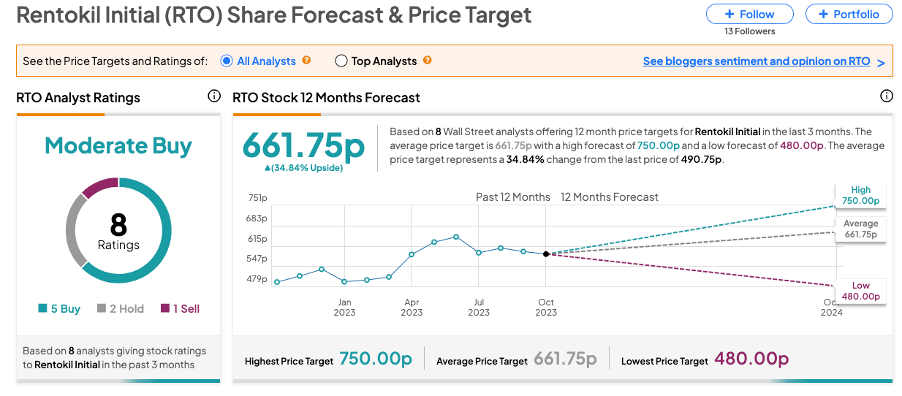

Yesterday, analyst Annelies Vermeulen from Morgan Stanley confirmed a Buy recommendation on the stock, predicting a 40% upside potential in the price.

Similarly, Bank of America Securities analyst Simona Sarli also reiterated a Buy rating, forecasting a 35% growth in the share price.

Overall, RTO stock has received a Moderate Buy rating based on five Buys, two Holds, and one Sell recommendation. The Rentokil share price forecast is 661.75p, which is 35% higher than the current price level.