FTSE 100 constituent Ocado Group (GB:OCDO) reported its half-yearly earnings for 2023 yesterday. The shares soared by 19% in a day after the group successfully transitioned to underlying profits of £16.6 million. This marked a significant turnaround from the loss of £13.6 million recorded in the same period of the previous year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite reporting a pre-tax loss of £289.5 million in its results, the company’s shares emerged as the top gainer on the FTSE 100 index. In the last year, the shares have demonstrated a decline of 8.3%.

Ocado Group is a globally recognized technology-driven business that specializes in software and robotics platforms. It offers a distinctive end-to-end solution for online grocery services worldwide.

H1 2023 Numbers

In its first-half results for 2023, the company posted a revenue jump of 9% in its revenues of £1.37 billion. The revenues of the company’s Solutions segment saw a notable 59% increase, primarily driven by the higher growth in its average live modules. On the other hand, the Retail segment’s revenue grew by 5%.

The underlying profits of £16.6 million are driven by increased customers in its Retail segment and an improved robotics business. The Retail business witnessed a growth of 10.6% in its customers and 4% in average orders per week.

Moving ahead, the company maintained its full-year guidance after gaining confidence from the positive numbers. The company also anticipates that Ocado Retail will achieve marginal EBITDA positivity for the entire year.

Analyst Giles Thorne from Jefferies commented that the full-year consensus numbers seem to have “clear upward pressure.”

While some analysts pointed out the losses and called the numbers “grim.”

What is the Price Target for Ocado Stock?

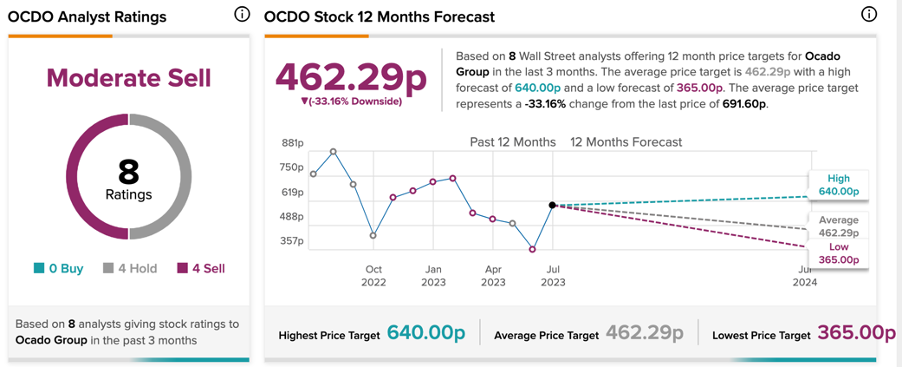

According to TipRanks’ analyst consensus, OCDO stock has a Moderate Sell rating. The stock has four Hold, and four Sell recommendations.

The average share price forecast is 462.3p, which is almost 33.16% lower than the current price level.