As compared to its global counterparts, the FTSE 100 index was quite strong and traded in the green zone with a return of 1.25%. The UK market consists of a lot of good dividend-paying stocks because there are a lot of defensive and cash-rich companies on the list.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based on this, we have shortlisted utility company National Grid (GB:NG) and telecom giant BT Group (GB:BT.A) from the FTSE 100 list. Both companies have dividend yields above 5%, which is much higher than their sector’s peers.

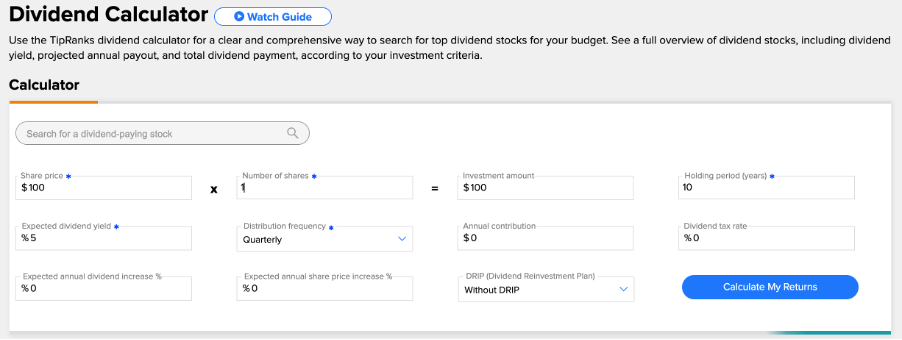

Investors can also explore the TipRanks Dividend Calculator tool to compare the dividend payments of different stocks. This tool has factors like dividend growth, share price growth, holding period, expected yield, and more, which can be customized as per your needs. The end results of the analysis include the overall return in percentage, annual dividend income, total dividend payment, etc.

Let’s see the stocks in detail.

National Grid PLC

National Grid is among the biggest utility companies in the world, engaged in the distribution of electricity and gas.

Utility companies have a natural advantage in a recessionary environment with their stable cash flows. The interim results for 2022 proved this right, with a 50% jump in its operating profits of £2.2 billion. The profits before tax also increased by 45% to £1.5 billion.

The stable earnings have helped the company to be consistent with its dividend payment over the last few years, including the pandemic years. In its interim results, the dividend increased by 4% to 17.84p, up from 17.21p in 2021.

Talking about the outlook, the company is positive about its earnings growth with its continued investments in the energy infrastructure. It targets a capital investment of £40 billion for a five-year period up to 2025/26, which will drive EPS growth of 6-8%.

Furthermore, in terms of valuation, the shares are not overpriced when compared to its competitors, Centrica (GB:CNA) and SSE (GB:SSE), which have P/E ratios of -6.2 and 19.7, respectively.

National Grid Share Price Forecast

According to TipRanks’ analyst consensus, National Grid stock has a Moderate Buy rating.

The average price target is 1,081.5p, which is almost 6% higher than the current price. The stock price has a high forecast of 1,210p and a low forecast of 952p.

BT Group PLC

BT Group is the biggest telecommunications services provider in the UK, including fixed-line, broadband, and mobile. The company’s stock price has been a victim of disagreements between the management and staff, which resulted in a lot of strikes.

The share price also dipped after the company reported its interim results for 2022 with just a 1% increase in its revenues of £10.4 billion. The profit before tax was down by 18% to £831 million, mainly due to higher depreciation costs.

However, the strikes are now in the past, and the company is looking forward to working on its transformation plans and generating £3 billion of cost savings by 2025.

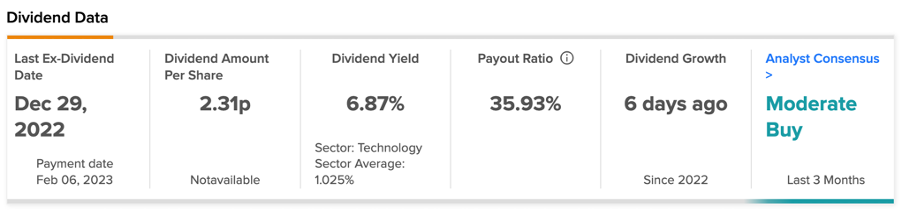

Overall, BT Group is a popular stock among value investors due to its above-average dividend yield. The company has a compelling dividend yield of 6.87%, as compared to the sector average of 1.02%. In its interim results for 2022, the company announced a dividend of 2.31p per share, which was the same as the last year’s interim dividend.

BT Group Share Price Forecast

BT Group also has a Moderate Buy rating on TipRanks. This includes two Buy and four Hold recommendations. The share price forecast is 183.3p, which has a huge upside potential of 60%.

Conclusion

These stocks should be considered by value investors seeking good passive income from their portfolios.