FTSE 100 constituent CRH PLC (GB:CRH) yesterday raised its interim dividend after posting strong numbers in its first-half earnings for 2023. The company anticipates substantial backing from the U.S. government for significant-scale investments, which is projected to drive demand for its offerings over the long term.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company posted growth of 8% in its sales of $16.1 billion and 14% in its earnings of $2.5 billion for the half-year. The dividends were increased by 4% to $0.25 per share. The interim dividend, to be entirely disbursed in cash, is scheduled for payment on November 22, 2023, and the ex-dividend date is set for October 19, 2023.

CRH’s share price followed a different route following the results and traded down by 1.31% on Thursday. While numerous FTSE 100 stocks have encountered turbulence in the year 2023, CRH has remained unaffected by such issues. The stock has demonstrated exceptional performance this year, accumulating a YTD gain of more than 30%.

CRH is a leading manufacturer and supplier of a range of basic materials to the construction industry. With its presence spanning across North America, Asia, and Europe, the company conducts operations in more than 30 countries.

Betting High on Infrastructure Growth

In its forward outlook, CRH anticipates that its North American operations will receive substantial backing from strong infrastructure demand. This support is driven by notable increments in both U.S. federal and state funding as well as positive activity within essential non-residential sectors. Even though the residential sector will remain challenging in Europe, the company is optimistic about robust infrastructure demand and encouraging price trends.

The company’s revised projection points to full-year group core earnings of approximately $6.2 billion, reflecting an increase from the $5.6 billion recorded in 2022.

What is the Price Target for CRH?

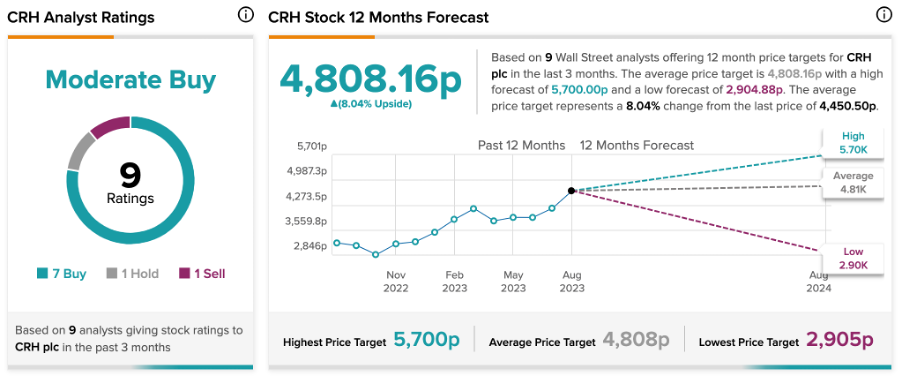

Analysts are also positive about the company’s investment prospects. Of the nine analyst ratings on the CRH stock, seven are Buy. One analyst has rated it a Hold, while another has given it a Sell rating on TipRanks. The average share price forecast is 4,808.16p, which is 8% higher than the current price level. The shares have gained a huge 41% in trading over the last 12 months. As a result, future growth prospects appear to be relatively moderate.