Banking giant Barclays (GB:BARC) and analytics company RELX (GB:REL) from the FTSE 100 will report their full-year earnings for 2022 this week. Analysts expect Barclays’ profits to be hit due to various litigation and other charges on the bank. RELX, on the other hand, is on track to deliver its revenue and profit growth as per its guidance numbers.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Analysts expect these stocks’ share prices to rise further and have maintained their Buy ratings ahead of earnings.

The TipRanks Earnings Calendar is an ideal tool for investors to get all the latest information about upcoming earnings. This tool is available for seven different markets, including the UK, Australia, Singapore, the U.S., etc.

Let’s have a look at the details.

Barclays PLC

Headquartered in the UK, Barclays is a global financial institution that provides services like retail banking, wealth management, investment banking, and more.

Barclays will announce its fourth quarter and full-year results for 2022 on February 15, 2023, before the market opens. The third-quarter EPS of 0.09p beat the consensus estimate of 0.08 p. However, for the fourth quarter, the analysts expect an EPS of 0.06p for the quarter, which is down from 0.07p in the prior year’s quarter.

The analysts see 2022 as a challenging year for the bank, including its litigation and governance issues, which will be visible in the results as well. The bank is expected to take a charge of £1.2 billion for higher bad debts and £1.6 billion for an illegal sale of U.S. securities.

The surge in such charges will push the bank’s profits down from £8.4 billion in 2021 to an expected number of £7.2 billion in 2022. In terms of its costs, the bank expects its operating expenses to increase to £16.7 billion, up from £14.4 billion in 2021.

Last week, Barclays again came under the UK regulator’s investigation on compliance and anti-money laundering issues.

What Is Barclays Stock Price Target?

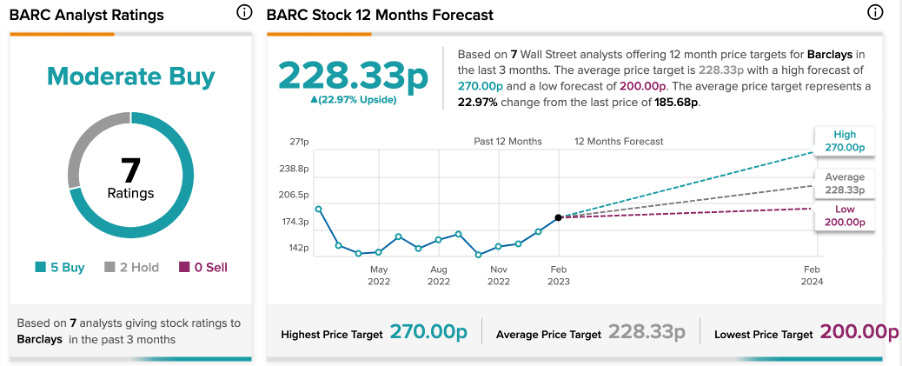

The bank’s stock has been volatile in the last year and gained some momentum after touching a low point in October. In the last three months, the stock has gained almost 18%. The analysts still forecast around a 23% upside in the stock prices. In terms of its valuation, Barclays’ stock looks inexpensive at a P/E ratio of 7.0, as compared to its other banking peers.

According to TipRanks’ analyst consensus, BARC stock has a Moderate Buy rating.

The average target price is 228.3p, with a high forecast of 270p and a low forecast of 200p.

RELX PLC

RELX is a UK-based company providing information and analytics solutions in more than 180 countries.

The company has witnessed a positive year in 2022 and expects full-year growth rates in revenues and operating profit to remain above historic levels. In the first half of the year, the company closed six acquisitions for £342 million, which will push the top line. In the first nine months, the revenue growth rate was 9% YTD.

The company will report its Q4 and full-year earnings for the period ended on December 31, 2022. The consensus EPS forecast is 0.54p for the quarter, up from 0.48p in the Q4 of 2021.

Analysts remain confident about the company’s pricing power, which is a great advantage in the current climate. The expected revenue for the company is $9.5 billion for 2022, which is around 33% higher than the previous year.

Is RELX Stock a Good Buy?

In the previous year, the stock increased by about 9%.

The stock has a total of nine ratings on TipRanks, including six Buy recommendations. Overall, the REL stock has a Moderate Buy rating at a target price of 2,924.40p. It shows an upside of 22.3% on the current price level.

Conclusion

As investors await the next set of results for these companies, analysts remain confident in the stock’s decent upside potential.