The share price of British insurer Aviva PLC (GB:AV) skyrocketed today by nearly 7%, driven by speculation regarding a potential acquisition by a foreign investor. The market buzz has ignited investor interest in potential suitors eyeing the insurance giant.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

At the time of writing, the shares were trading at a gain of 7.16% on Friday. Investors reacted swiftly to the news, leading to a remarkable 10% increase in Aviva’s stock during the early morning trading session.

Aviva is a prominent player in the insurance sector and has a substantial global footprint with operations in various markets. The company has been a key player in the UK insurance landscape for many years, offering a range of products, including life insurance, general insurance, and asset management.

The Speculation

The identity of the interested buyer remains undisclosed. However, some reports suggest names like German group Allianz SE (DE:ALV), Canadian firm Intact Financial Group (TSX:IFC), and Scandinavian insurance company Tryg A/S (DE:T2V1) as interested buyers. Analysts believe that speculation involving overseas entities like Allianz, Intact Financial, and Tryg as potential suitors has boosted the stock.

Aviva is anticipated to generate robust free cash flow and excess capital while possessing an attractive valuation. Recent strategic streamlining efforts have concentrated on bolstering the robust segments of the business, presenting an opportunity to expand its presence in the lucrative bulk annuities market.

The news followed a positive broker note earlier this week. Two days ago, analyst James Pearse from Jefferies reiterated his Buy rating on the stock, predicting a 16% increase in the share price.

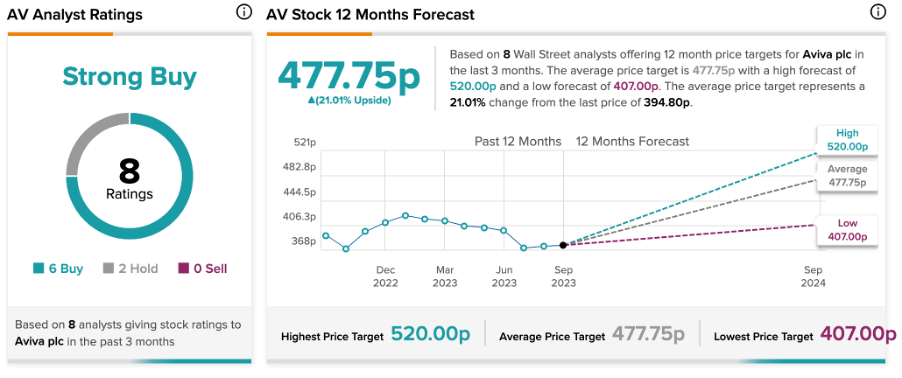

Aviva Share Price Forecast

Analysts maintain a positive outlook on AV stock, assigning it a Strong Buy rating on TipRanks. This sentiment is underpinned by six Buy and two Hold recommendations. The Aviva share price forecast is 477.75p, which offers growth of around 21% from the current trading levels.