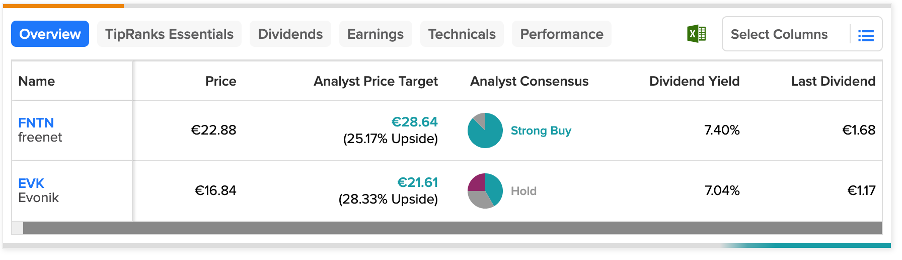

German companies freenet AG (DE:FNTN) and Evonik (DE:EVK) are two options that can be considered by investors seeking additional income for their portfolio. Both stocks have higher dividend yields, above 7%. FNTN carries a dividend yield of 7.4%, while Evonik offers a rate of 7.04%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In terms of capital appreciation, analysts have rated freenet as Strong Buy. In contrast, EVK stock has a Hold rating.

TipRanks offers users a variety of tools to help them choose the most appropriate dividend stocks based on their specific needs. Here, we have used theBest German Dividend Stocks to shortlist these two companies, along with various other factors.

Let’s take a look at the two stocks in detail.

freenet AG

freenet is a telecommunications company, providing products and services in the fields of mobile radio, internet, TV, and more.

The company has a dividend yield of 7.4%, as compared to the sector average of 2.54%. In May 2023, the company paid a dividend of €1.68 per share, which was 7% higher than the previous year’s payment of €1.57. freenet continues to sustain its dividend consistency in alignment with its business achievements.

Yesterday, Simon Keller from Hauck & Aufhaeuser confirmed his Buy rating on the stock at a growth forecast of 35.5% in the share price. The price target remains unchanged at €31.0.

Freenet Share Price Target

According to TipRanks, FNTN stock has a Strong Buy rating based on seven Buy and one Hold recommendations. The average price forecast is €28.64, which is 25% above the current trading levels.

Evonik Industries AG

Evonik is a global player in the specialty chemicals industry that manufactures various additives for multiple industries.

In 2023, the company paid a dividend of €1.17 per share, which was similar to last year’s payments. In 2023, the company anticipates a decrease in profits due to challenging market conditions. However, the company expects to keep its dividend stable at €1.17 per share.

The company has successfully maintained its shareholder-friendly policies regarding remuneration and dividends. However, investors should not anticipate any substantial dividend hikes in the near future.

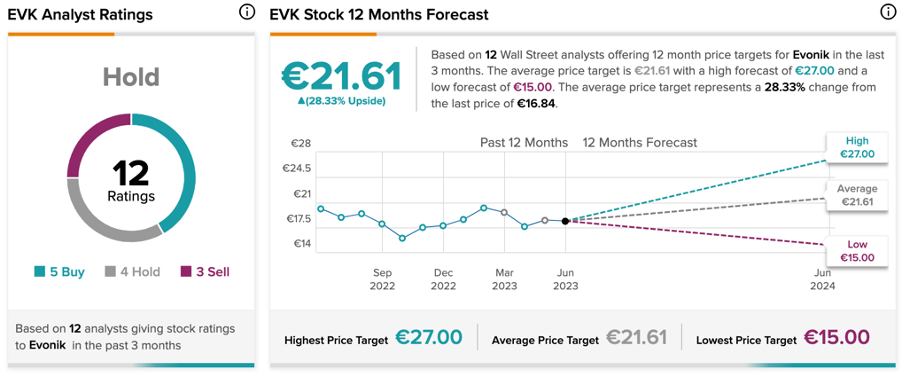

Is Evonik a Good Stock to Buy?

EVK stock has a Hold rating on TipRanks based on a total of 12 recommendations, of which five are Buy. It also includes four Hold and three Sell recommendations. The target price of €21.61 is around 28.3% higher than the current level.

Conclusion

These German companies present a favorable option for investors seeking income-oriented opportunities. Additionally, these companies also offer more than 20% upside potential in their share prices.