The ASX-listed Fortescue Metals Group Limited (AU:FMG) share price tumbled over 5% after the company posted weak profits and cut its dividend in its FY 2023 earnings report. Despite posting a record performance in its iron ore shipments of 192 million tonnes during the year, the company’s profits were hit by higher costs and an impairment charge of $1 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a result, the company joined the list of other big miners like BHP Group (AU:BHP) and Rio Tinto Limited (AU:RIO), which also announced dividend cuts in their recent earnings. Fortescue declared a final dividend of AU$1 per share, resulting in a cumulative payment of AU$1.75 per share for the year 2023. This figure represents a 15% decrease compared to the dividends disbursed in the fiscal year 2022.

The investors responded cautiously, and the shares traded down by 5.06% in today’s session. Fortescue‘s share price has remained volatile so far this year, with a mere 1.2% gain YTD.

Fortescue Metals is an Australian mining company specializing in iron ore production. The company delivers over 180 million tonnes of iron ore annually from the Pilbara, securing its position as the world’s largest iron ore producer.

Let’s take a look at some of the numbers.

FY2023 Earnings and a New CEO

The revenues were down by 3% to $ 16.87 billion, but slightly exceeded expectations from analysts. The underlying net profit after tax fell by 11% to $5.5 billion, mainly hit by an impairment charge of $726 million ($1 billion pre-tax) for its new project site, Iron Bridge. In terms of iron ore production, the company hit the top range of guidance numbers and delivered 192 million tonnes for the year.

The company also announced the appointment of its new CEO, Dino Otranto, who will replace Fiona Hick. Otranto, presently serving as the COO of the iron-ore mining division, became a part of Fortescue in 2021, bringing with him over 20 years of experience in the energy industry.

Is Fortescue Metals a Good Buy?

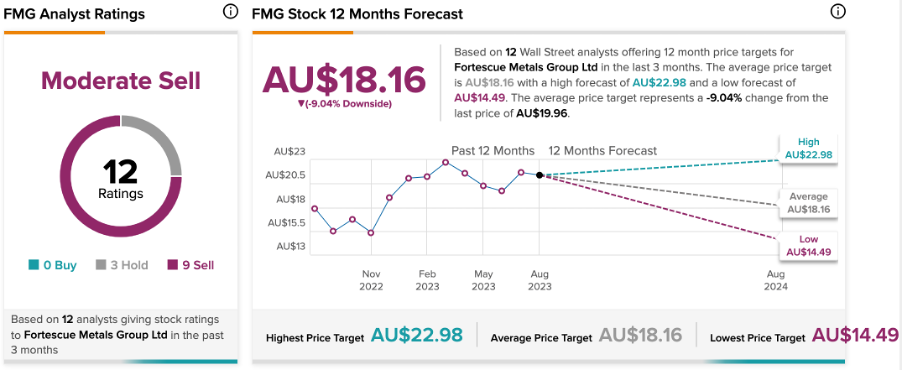

In terms of share price appreciation, analysts are not so positive about the stock as evidenced by its Moderate Sell rating. According to TipRanks consensus, FMG stock has received nine Sell and three Hold recommendations. The Fortescue share price target of AU$18.16 is 9% lower than the current trading levels.

It is important to note here that these ratings were last assigned in the previous month and might be subject to alteration following the company’s recent earnings announcement.