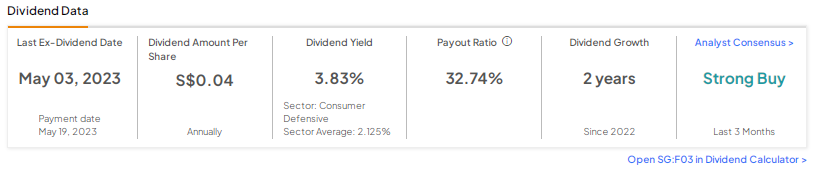

SGX-listed Food Empire Holdings Limited (SG:F03) stands out as a highly desirable dividend stock in the Singapore market. The company increased its FY22 dividends by 100% and has a dividend yield of 3.83%, against the industry average of 2.125%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Food Empire is a prominent manufacturer in the food and beverage sector. The company sells branded instant beverages, frozen convenience foods, confectionery, and snacks in over 50 countries.

TipRanks offers a variety of tools to help users choose dividend stocks that match their criteria. These tools, like Top Dividend Shares, Dividend Calculators, and Dividend Calendars, streamline the process of screening and selecting stocks within specific markets.

Let’s take a look at the details.

Food Empire Holdings Dividend Date

For its Fiscal year 2022, the board approved a record dividend of S$.044 per ordinary share, which was paid on May 19, 2023. This was significantly higher than the dividend of S$0.02 paid in May 2022.

Looking ahead, analysts expect the company to further increase its dividends on the back of robust product demand and earnings growth.

Analyst William Tng from CGS-CIMB sees the end of the capital expenditure cycle as a positive factor. This development could potentially enable the company to return more cash to shareholders.

Bullish Analysts

Food Empire’s Q3 net profit declined by 30.6% to $15.7 million, mainly due to the lack of a one-time gain of $15 million from the disposal of a non-core asset in Q3 2022. However, the company recorded improved operating profits, driven by its performance in Vietnam and Kazakhstan, and reduced foreign exchange losses.

Following its third-quarter earnings for FY23, analysts have reaffirmed their Buy ratings on the stock, demonstrating continued confidence in the company’s future earnings. Analyst Heidi Mo from UOB Kay Hian is bullish on the company’s product demand in its key markets and raised her earnings target by 8% and 9% for 2023 and 2024, respectively.

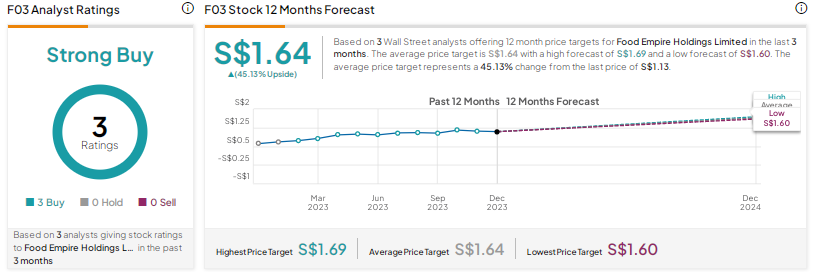

Food Empire Share Price Target

Year-to-date, Food Empire’s stock has recorded a gain of over 70%.

On TipRanks, F03 stock has been assigned a Strong Buy consensus rating based on three Buy recommendations. The Food Empire share price target of S$1.64 reflects an upside of 45% from the current level.