Shares of British e-gaming operator Entain plc (GB:ENT) gained 4.1% yesterday after Jefferies analyst James Wheatcroft upgraded his rating to Buy from Hold, citing recent developments. Wheatcroft assigned a higher price target of 1,215.00p (23.7% upside) to Entain shares, up from 890.00p.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Entain is an FTSE 100-listed company. It is an international sports betting and gambling service provider. Entain’s popular brands include Bwin, Coral, Ladbrokes, PartyPoker, and Sportingbet. Year-to-date, ENT shares have lost 26.2%.

Here’s Why Wheatcroft is Bullish on ENT

Wheatcroft cited two positive developments for his bullish view on Entain. Firstly, he believes that the departure of CEO Jette Nygaard-Andersen last week opened the doors for strategic initiatives. The CEO stepped down after the company recently settled a bribery case dating back to 2017. While potential mergers and acquisitions at the company could deter the hunt for a suitable new CEO, the analyst still sees the chances “for a highly credible CEO to land at Entain.”

Secondly, Wheatcroft sees the entry of American activist investor Corvex Management, which has extensive gambling experience, as a sign of potential deals. Following the CEO’s exit, hedge fund Corvex revealed a 4.4% stake in Entain, calling for a turnaround. Interestingly, Corvex’s founder and managing partner, Keith Meister, has a board seat at the American casino resort operator MGM Resorts (NYSE:MGM). Plus, Corvex has a 2% stake in MGM, the analyst noted.

Entain and MGM have a joint venture called BetMGM, which offers sports betting, online casino games, and poker in various states across the U.S. Wheatcroft thinks that MGM could vie to take up the entire control of BetMGM from Entain. Moreover, having Corvex as the common link could propel MGM to acquire 100% of Entain or acquire some assets from the British company.

What is the Stock Price Prediction for Entain?

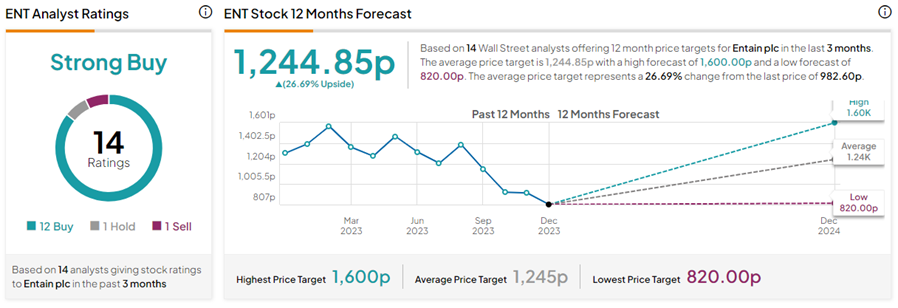

On TipRanks, the Entain share price prediction of 1,244.85p implies 26.7% upside potential from current levels. Also, with 12 Buys, one Hold, and one Sell rating, ENT stock commands a Strong Buy consensus rating.