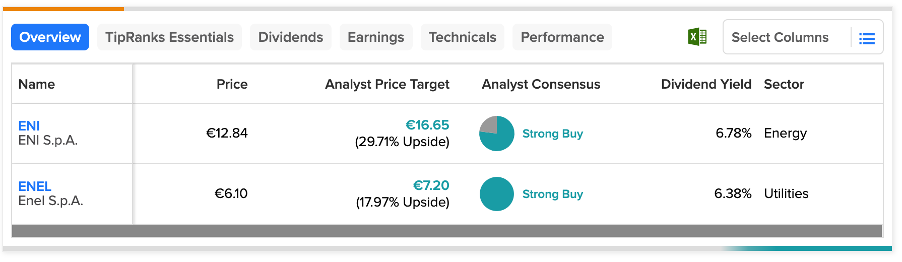

In today’s article, we have picked two energy companies, ENI S.p.A. (IT:ENI) and Enel S.p.A. (IT:ENEL), that are listed on the Borsa Italiana. Both of these stocks possess all the necessary elements to be considered promising investment opportunities and have been rated as Strong Buy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ENI exhibits the potential for almost a 30% increase in its share price, whereas Enel presents a growth opportunity of 18%. Moreover, these stocks also carry attractive dividend yields, checking the box for income investors.

Let’s take a look at the details.

ENI S.p.A.

Eni is an energy company engaged in the exploration, discovery, development, and production of crude oil, natural gas, and condensates.

The company’s stock remains a strong pick among investors in 2023. Following a year of achieving record profits, this company is positioned to surpass market expectations due to a combination of effective management decisions, favorable market conditions resulting from recent OPEC+ agreements, and advantageous positioning within the oil market.

Speaking of dividends, the company announced the distribution of 25-30% of cash flow through dividends and share buybacks. For 2023, Eni has announced that its dividend will increase by 7% to €0.94 per share.

Is Eni SpA a Good Buy?

According to TipRanks, ENI stock has a Strong Buy rating based on ten Buy and three Hold recommendations.

The average price forecast is €16.65, which has an upside of 30% on the current price level.

Enel S.p.A.

Based in Italy, Enel is a global company engaged in the production and distribution of electricity and gas.

Analysts are bullish on the stock considering the company’s progress on its debt-reduction strategy. As part of this, the company recently sold its assets in Romania and Peru. The company is also assessing the feasibility of implementing a fresh share buyback program.

Enel has a dividend yield of 6.38%, above the sector average of 2.9%. In 2022, the company paid a dividend of €0.38 per share. According to its strategic plan for the next two years, the company is targeting a dividend of €0.43 per share in 2023, €0.43 per share in 2024, and €0.43 per share in 2025.

Two days ago, analyst Fernando Garcia from RBC Capital reiterated his Buy rating on the stock, predicting an upside of 24% in the share price.

What is the Price Forecast for Enel?

ENEL stock has a Strong Buy rating on TipRanks backed by all nine Buy recommendations. The average price target is €7.2, which is 19.3% higher than the current trading level.

Conclusion

ENI and ENEL present an attractive investment opportunity, appealing not only to value investors but also to dividend-oriented investors seeking stable returns.

Both stocks have Strong Buy ratings on TipRanks.