Getting insights into insider trading could provide an edge to investors. Insiders rely on some non-public information that is not available to common investors. However, if investors are able to use this information on time, they can also make profitable transactions just like the insiders.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

TipRanks provides comprehensive coverage of insider transactions in various markets. The Daily Insider Transactions tool guides investors on the recent buying/selling of stocks by corporate insiders. It presents a list of all such transactions in the last two years, which can be filtered as per any customization.

Let’s have a look at these companies and their recent insider transactions.

Iberdrola, S.A. (ES:IBE)

Iberdrola operates in the renewable energy space and is committed to fighting climate change.

The company has rewarded its shareholders well in the last year, with a growth of 14% in the stock and a dividend yield of 3.3%. Over a five-year period, the stock has generated a 93% return for its shareholders.

Under its strategic plan, the company plans to invest €47 billion over the next two years in its network and renewable energy to speed up its energy transition.

According to TipRanks, corporate insiders have bought shares worth €5.3 million in the last three months. The transactions in this range depict brighter prospects for the company’s share prices. The insider confidence signal is neutral for the company.

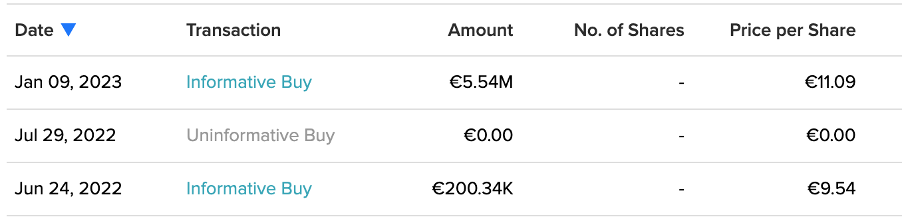

Getting into more detail, the most recent transaction was made by the company’s director, Xabier Sagredo Ormaza. He bought a big chunk of shares at €11.09 per share for €5.4 million. This transaction, which was an informative buy, was the first for the company in 2023.

Ormaza has a success rate of 100% on this stock, with an average return of 11.26%. Prior to this, his last transaction was in June 2022, when he made a profit of 12.5% on an investment of €200.3k.

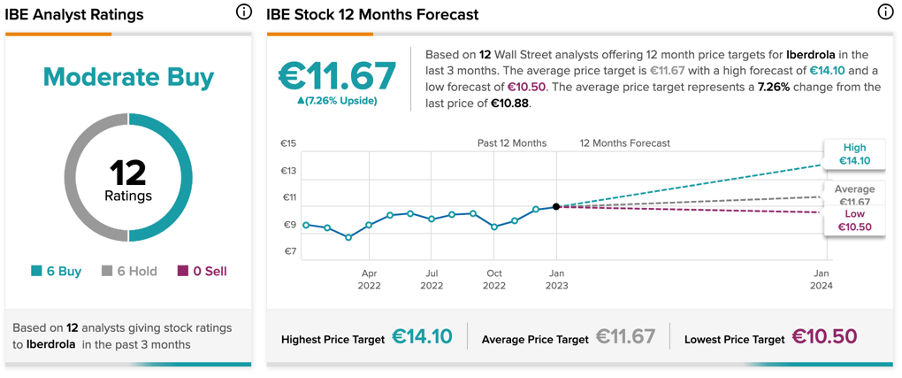

Is Iberdrola Stock a Buy?

According to TipRanks’ analyst consensus, Iberdrola stock has a Moderate Buy rating, based on six Buy, and six Hold recommendations.

The IBE target price is €11.67, which represents a 7.2% change in the price from the current level.

Telefonica, S.A. (ES:TEF)

Telefonica is among the leading telecommunications companies in the world. The company is known for its speed and coverage in Europe and the U.S.

Another highlight for the company is its consistent dividend payments. As compared to the sector average of 1.02%, Telefonica’s dividend yield is 9.89%.

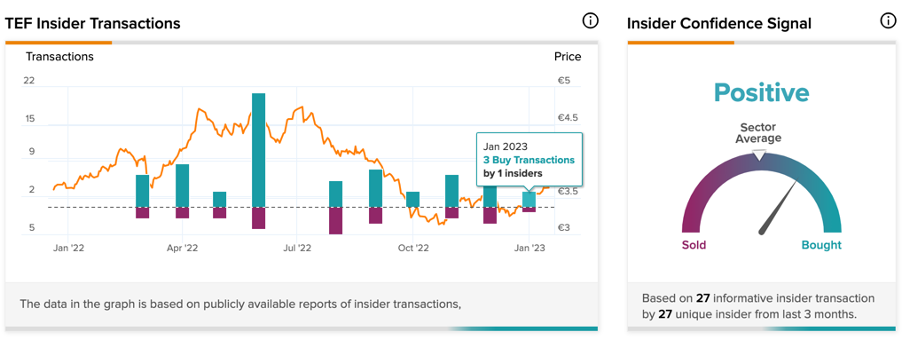

Moving on to insider trading, the company has a positive insider confidence signal. In the last three months, corporate insiders have purchased €66.7 million worth of shares. Among these, three buy transactions were completed this month.

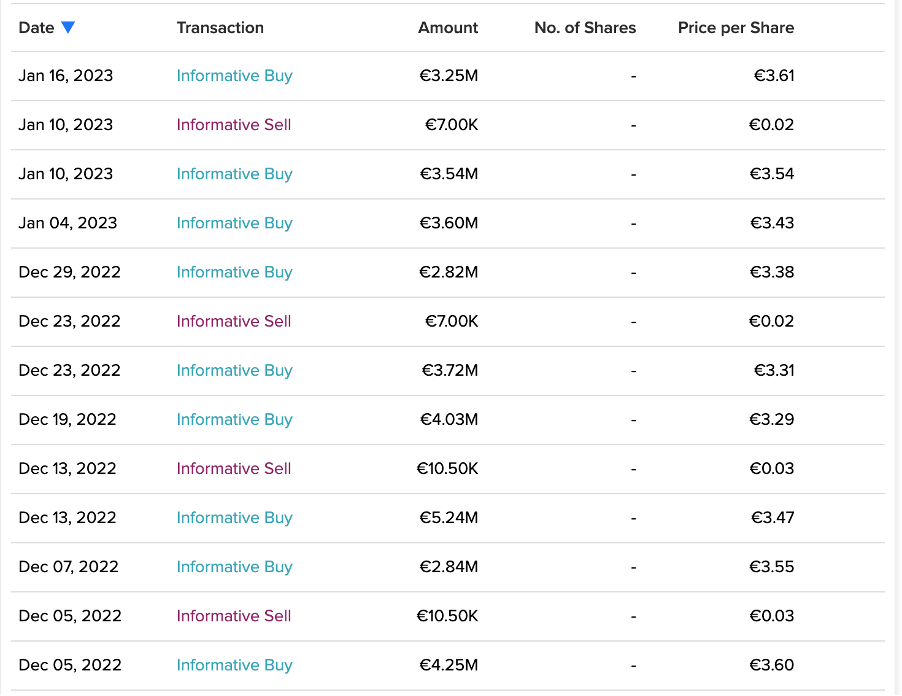

Most of these transactions were made by the company’s vice chairman, Isidro Faine Casas. He bought shares worth €10.3 million in January as an informative buy. He also made an informative sale of 3,50,000 shares worth €7000. He has a long history of transactions in Telefonica’s stock, with a total holding value of €388.3 million.

The below snapshot provides details of his transactions in the last two months.

Will Telefonica Stock Go Up?

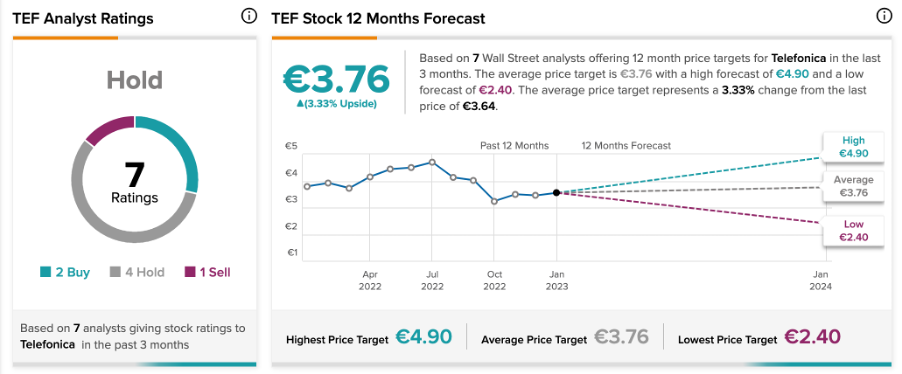

According to TipRanks, the average price forecast is €3.76, which has an upside potential of 3.3% on the current price level.

Overall, the stock has a Hold rating based on recommendations from seven analysts.

Conclusion

The TipRanks tools allow investors to track insider transaction data and make informed decisions based on it. These transactions of more than €1 million are clearly a signal for investors to make a move.