Shares of FTSE 250-listed EasyJet PLC (GB:EZJ) rose nearly 3% as investors welcomed the strong summer bookings in the Q1 FY24 trading update, defying turbulence in the Middle East. Investors also reacted positively to the quarter’s lower-than-anticipated pre-tax headline loss of £126 million, which reflected a more than 5% year-over-year reduction.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Over the last 12 months, EasyJet shares have rebounded and gained 12.5%, driven by huge travel demand.

EasyJet is a leading airline in Europe, operating in 34 countries. It is known for its cost-effective services.

Resilient Performance Amid Middle East Conflict

EasyJet recorded a 14% growth in passengers, reaching 19.8 million in the quarter. The airline’s tour operator EasyJet Holidays generated a £30 million profit in its holiday segment, with a 48% increase in customer numbers.

On the downside, the airline experienced a direct impact of £40 million from the conflict in the Middle East that led to the temporary suspension of certain flights. However, EasyJet saw a robust recovery in demand and bookings since late November.

Moving forward, the company is optimistic and anticipates a lower first-half loss. This is primarily driven by positive summer booking trends, with revenue per seat (RPS) expected to increase by mid-single digits in Q2 FY24. The positive momentum is also reflected in the EasyJet Holidays business, where customer growth is expected to exceed 35% in FY24 on a year-over-year basis.

Are EasyJet Shares a Good Buy?

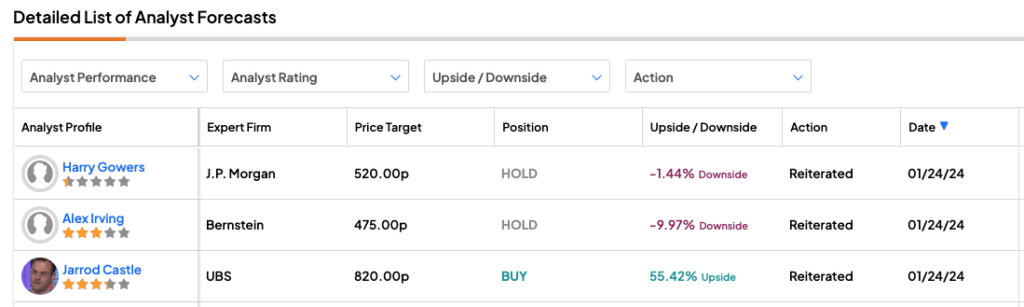

Post-results, UBS analyst Jarrod Castle confirmed his Buy rating on EasyJet shares, predicting an upside of 55%. On the contrary, analysts from J.P. Morgan and Bernstein maintained their Hold ratings, with an expected downside of 1.4% and 10%, respectively.

As per consensus among analysts on TipRanks, EZJ stock has been assigned a Moderate Buy rating. The company’s ratings consist of six Buy and five Hold recommendations. The easyJet share price target is 630.48p, which implies an upside potential of 19.45% from the current share price.