SGX-listed Dyna-Mac Holdings Ltd (SG:NO4) fell over 3% today after a Maybank analyst cut the price target on the stock in reaction to the company’s five-for-one bonus issue. Analyst Jarick Seet slashed the price target on NO4 to S$0.38 from S$0.51. The new price target reflects an 18.7% upside potential from the stock’s closing price of S$0.32 as of January 4.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Singapore-based Dyna-Mac is a global leader in the design and construction of modules for the hydrocarbons industry. The offshore oil and gas contractor operates in the Asia Pacific, Europe, and the Americas. Notably, NO4 shares have gained 73.9% in the past year.

Dyna-Mac’s Bonus Issue

On January 4, Dyna-Mac announced a bonus issue of up to 207.4 million warrants, offering one warrant for every five shares held by its existing shareholders. Each warrant is convertible to an ordinary share at an exercise price of S$0.15, reflecting a discount of 46.4% to the last transacted price on December 15, the last trading day before the initial news of the bonus issue was out.

The bonus issue and resulting share conversion will help the company raise S$31.1 million in gross proceeds. These would be used towards capital expenditures to develop yards, working capital, and general corporate purposes.

Dyna-Mac board believes that the bonus issue will help reward shareholders while also allowing them to further participate in the company’s future growth. Plus, it would increase the trading liquidity of Dyna-Mac shares. Considering full conversion, the company’s outstanding float would increase to 1.2 billion shares.

About the Price Target Cut

Analyst Seet expects the warrants to be fully converted if the shareholders approve the bonus issue, increasing the share count and leading to further dilution. Moreover, he believes that the exercise price of S$0.15 per share is steeply discounted. His price target cut accounts for the 100% dilution effect. Seet’s price target is pegged at 16.5x his FY2024 price/earnings (P/E) multiple.

Nonetheless, Seet retained a Buy rating on NO4 shares following the news of its Exterran Offshore acquisition. On January 3, Dyna-Mac announced that it was acquiring 100% of Exterran Offshores’ shares for S$11.0 million. The takeover will give Dyna-Mac access to 4.5 hectares of yard facilities and increase its fabrication capacity by 30%. Accordingly, Seet has increased the company’s FY24 and FY25 earnings estimates by 10%.

What is the Price Target for Dyna-Mac?

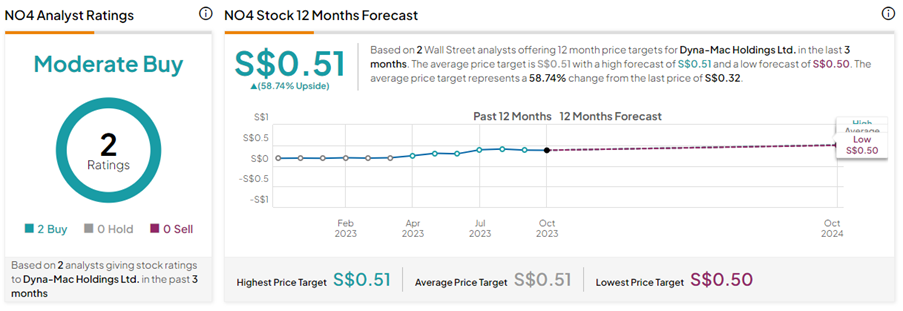

Based on two Buy ratings received during the past three months, NO4 stock has a Moderate Buy consensus rating. On TipRanks, the Dyna-Mac share price target of S$0.51 implies 58.7% upside potential to current levels.